Rebalancing is a cornerstone of the wealth management industry. It allows advisors to manage risk, capitalize on market opportunities, and align investments with their clients’ changing goals and time horizons. By periodically adjusting the portfolio’s allocation, rebalancing ensures that investments remain in line with long-term objectives and risk tolerance, while also providing a disciplined approach to investing. It also fulfills the fiduciary responsibilities for advisors, as it helps them maintain suitable investment strategies for their clients.

For years now, the quarterly rebalance has been an industry norm. In this practice the portfolio is allowed to “drift” for three months. For the advisory firm, this also allows them to minimize the manpower needed to review and rebalance portfolios. Instead of constantly monitoring and adjusting portfolios throughout the year, advisors can dedicate specific periods to rebalance portfolios. This time allocation enables advisors to focus on other essential tasks and responsibilities, such as financial planning, client meetings, and business development.

While offering quarterly rebalancing may sound sophisticated and systematic on the surface, in practice it can be quite limiting. Choosing to rebalance on an arbitrary timeline fails to take into account an array of variables within client and household accounts and market conditions. Ideally, accounts would be rebalanced as needed, dynamically, based on individual goals and needs. Obviously, this rebalancing approach requires a lot of bandwidth and scale to implement at a firm level. Dynamic rebalancing, while arguably advantageous for clients, has historically been incongruent with firm productivity and efficiency. Today’s technology and tools have changed that and taken the implementation of dynamic rebalancing from a pipe dream to a reality.

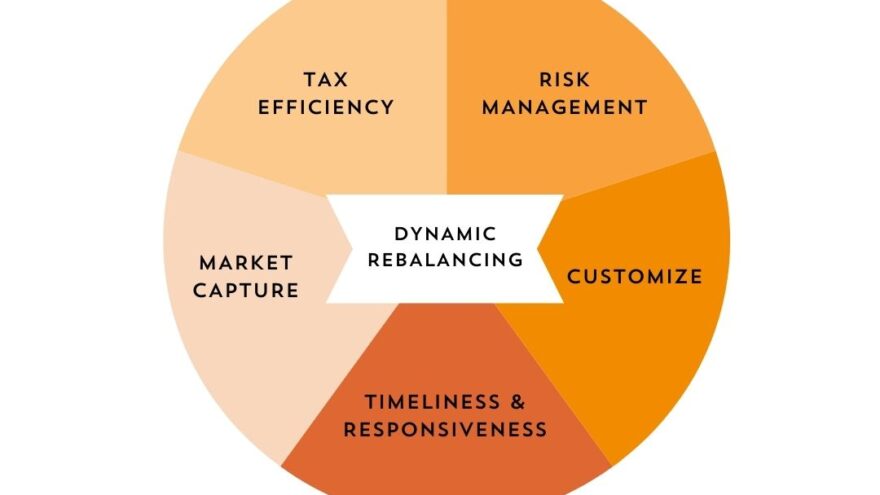

Advisors now have the ability to monitor, assess, and implement rebalancing across their entire book of business on a daily basis. Making adjustments to individual portfolios, only when needed. There are several benefits to taking this dynamic approach:

Timeliness and Responsiveness: Quarterly rebalancing adheres to a fixed schedule, typically done every three months. This approach may result in missed opportunities or delayed adjustments in response to changing market conditions. On the other hand, dynamic rebalancing continuously monitors portfolios and makes adjustments whenever specific thresholds or criteria are met. This real-time responsiveness allows portfolios to capture opportunities or mitigate risks promptly.

Risk Management: Quarterly rebalancing may lead to prolonged exposure to assets that have deviated significantly from the target allocation. If market conditions change rapidly during that time, it could result in increased portfolio volatility or exposure to undesired risk levels. Dynamic rebalancing, with its frequent monitoring, identifies and addresses these deviations promptly. By maintaining the desired asset allocation, it helps manage risk more effectively and ensures portfolios remain aligned with the investor’s risk tolerance.

Tax Efficiency: Quarterly rebalancing involves selling and buying securities at predetermined intervals, potentially triggering taxable events. This can result in unnecessary tax consequences, especially if market conditions fluctuate during the holding period. Dynamic rebalancing takes into account tax efficiency by considering factors such as capital gains, losses, and tax implications of trades. It seeks to minimize the tax impact of rebalancing adjustments, leading to potentially improved after-tax returns for investors.

Note: A tax harvesting program should be run aside a dynamic rebalance process

Market Capture: Quarterly rebalancing may miss out on short-term market trends or opportunities that occur between rebalancing dates. Market dynamics can change rapidly, and static rebalancing may not capture these fluctuations. Dynamic rebalancing, with its continuous monitoring, allows portfolios to react to market movements and take advantage of potential opportunities as they arise. This agility can potentially enhance portfolio performance and capture market upside.

Customization: Quarterly rebalancing typically applies the same rebalancing parameters to all clients within a specific timeframe. This approach may not fully account for each client’s unique circumstances, goals, or risk tolerance. Dynamic rebalancing, on the other hand, offers customization by analyzing each client’s portfolio individually. It considers their specific investment objectives, risk tolerance, and market conditions to tailor the rebalancing process accordingly. This customization ensures that portfolios are optimized based on each client’s needs and preferences.

In summary, dynamic rebalancing surpasses quarterly rebalancing by providing timely adjustments to portfolios, proactive risk management, enhanced tax efficiency, the ability to capture market opportunities, and customization based on individual client circumstances. By leveraging real-time data and advanced technology, dynamic rebalancing aims to optimize portfolio performance and align portfolios with changing market conditions, ultimately benefiting investors in the long run.

IMPORTANT DISCLOSURE: The information contained in this report is informational and intended solely to provide educational content that we find relevant and interesting to clients of Fountainhead. All shared thought represents our opinions and is based on sources we believe to be reliable at the time of publication. While we continue to make these reports available, we do not update past reports in light of subsequent events. Nothing in this letter should be construed as investment advice; we provide advice on an individualized basis only after understanding your own circumstances and needs.