- Browse By Category:

- All Posts

- Advisor Insights

- Press Releases

- From the Desk of Our CIO

- Case Studies

- Podcasts

All Posts

INVESTMENT WARS: WILL THE CRYPTO ECOSYSTEM DISRUPT BOTH FIAT CURRENCY AND DIGITAL TECHNOLOGIES?

April 16, 2024

Debate: Will the Crypto Ecosystem Disrupt Both Fiat Currency and Digital Technologies? Featuring: David LaValle, Senior Managing Director and Global

MARKET COMMENTARY: THE EFFECTS OF ONSHORING ON THE US AND ITS CONSUMERS

April 8, 2024

We are a consumer-led economy. And boy, do we do a good job consuming! As of 2022, the United States

INVESTMENT WARS: WILL THE FED REALLY CUT RATES THREE TIMES THIS YEAR?

April 5, 2024

Debate: Will the Fed Really Cut Rates Three Times this Year? Featuring: Michael Shaoul, Chairman, Portfolio Manager and CEO of

INVESTMENT WARS: DO RECENT DISRUPTIONS IN THE REAL ESTATE SECTOR CREATE OPPORTUNITY IN 2024?

March 19, 2024

Debate: Do Recent Disruptions in the Real Estate Sector Create Opportunity in 2024? Featuring: Lauren Hochfelder, Co-Chief Executive Officer of

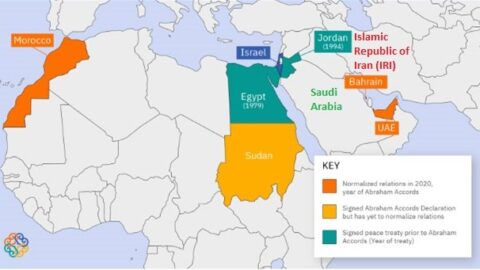

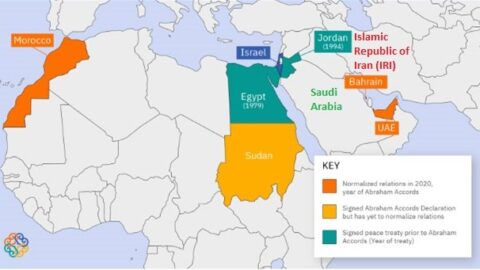

MARKET COMMENTARY: GLOBAL TREMORS: OPTIMISM AND CONCERNS

March 8, 2024

On a recent international trip, I watched Golda and All the President’s Men, two movies based on historical events that

INVESTMENT WARS: WILL ROBOTS TAKE OVER THE WORLD?!

February 8, 2024

Debate: Will Robots Take over the World?! Featuring: Zeno Mercer, an expert on Robotics with VettaFi RoboGlobal Indexes. Zeno is

MARKET COMMENTARY: VALUE, TRUST, BITCOIN & HUMAN INGENUITY

February 5, 2024

I remember visiting my uncle’s house in the early ‘90s and watching with fascination as my cousin, 15 years younger,

INVESTMENT WARS: HOW STRONG IS THE TREND TOWARDS RESHORING OF MANUFACTURING?

January 16, 2024

Debate: How Strong Is the Trend Towards Reshoring of Manufacturing? Featuring: Chris Semenuk, Investment Partner with Tema ETFs. Is the

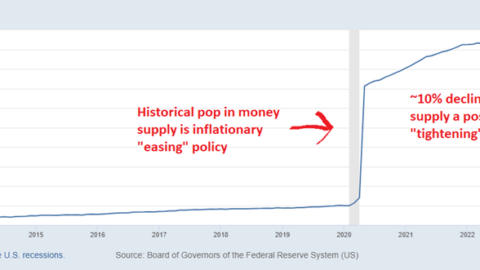

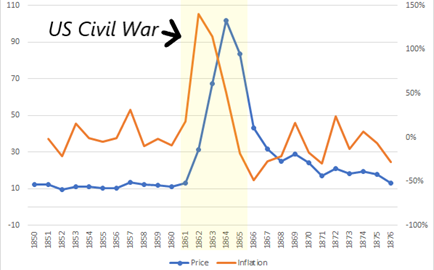

MARKET COMMENTARY: INFLATION: LOCAL AND GLOBAL FACTORS – WHAT IS IN STORE FOR 2024

January 5, 2024

Mongol Empire Khagan-Emperor Kublai Kahn wanted to be more like his dad and grandpa, Genghis Khan, spurring on wars that

INVESTMENT WARS: AN INSIDER VIEW OF DISRUPTION WITHIN THE AUTO INDUSTRY

December 20, 2023

Special Episode: An Insider View of Disruption within the Auto Industry Featuring: Dr. Philip Koehn, who has over two decades

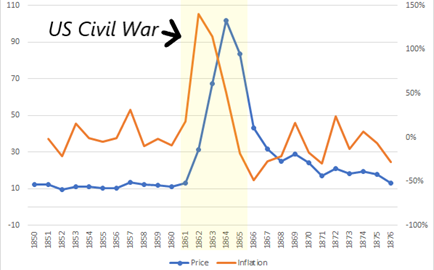

MARKET COMMENTARY: GLOBALIZATION, WAR, AND INFLATION

December 11, 2023

There has always been “international” trade of physical goods, knowledge, and concepts. Just two famous examples are the great library

INVESTMENT WARS: IS COMMERCIAL REAL ESTATE A RISK OR OPPORTUNITY?

December 6, 2023

Debate: Is Commercial Real Estate a Risk or Opportunity? Featuring: Burl East, Portfolio Manager and Chief Executive Officer of American

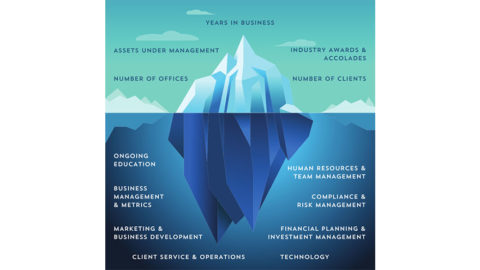

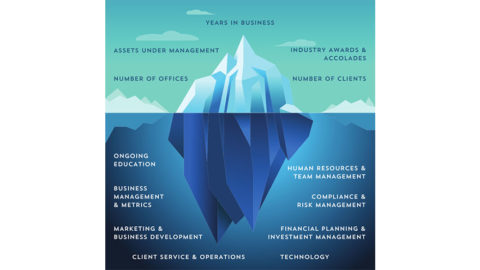

EMPOWERING FINANCIAL PLANNERS: HOW AN OCIO ENHANCES AN RIA’S VALUE PROPOSITION

November 30, 2023

Registered Investment Advisor (RIA) firms whose primary value proposition is providing comprehensive financial planning services have an opportunity to significantly

INVESTMENT WARS: WILL THE US HAVE A DEEP RECESSION?

November 8, 2023

Debate: "Will the US Have a Deep Recession?" Featuring: Victoria Vogel, CFA, Senior Vice President and Product Specialist for Fixed

MARKET COMMENTARY: RECESSIONARY WINDS

November 6, 2023

The job of the Federal Reserve (“Fed”) is to maintain a healthy and stable economy and financial system. Generally speaking,

ADVANTAGES OF HIRING AN OCIO OVER AN IN-HOUSE CIO: ELEVATING INVESTMENT MANAGEMENT FOR RIAS

October 30, 2023

As a Registered Investment Advisor (RIA) firm begins to build and grow, one of the many significant decisions they face

INVESTMENT WARS: WILL THE US HAVE A SHALLOW RECESSION?

October 18, 2023

Debate: "Will the US Have a Shallow Recession?" Featuring: Jack Janasiewicz, CFA, Portfolio Manager and Lead Portfolio Strategist for Natixis

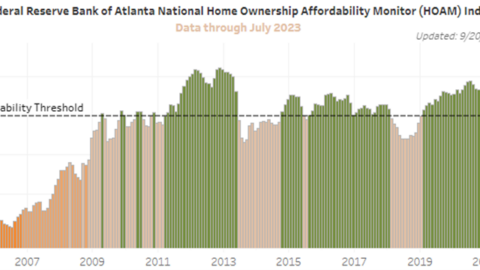

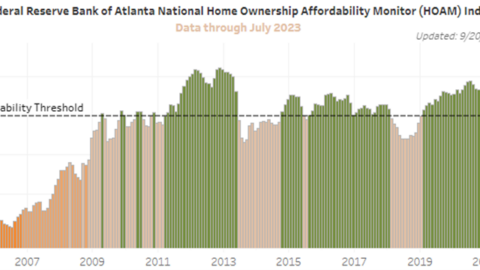

MARKET COMMENTARY: EXPENSIVE HOUSING AND POTENTIAL CONSEQUENCES

October 6, 2023

The average purchase of a residential dwelling in the US consists of 20% down and 80% in loans[1], typically taken

THE DOWNSIDES OF AN RIA MANAGING THEIR OWN PORTFOLIOS

October 4, 2023

What RIAs are Risking by Self-Managing Client Portfolios As a Registered Investment Advisor (RIA), providing investment management of client portfolios

INVESTMENT WARS: CHINA IN TRANSITION – WILL THE CHINESE CONSUMER AND CAPITAL SPEND DRIVEN INNOVATION PROPEL CHINA FORWARD?

September 26, 2023

Debate: "China in Transition: Will the Chinese Consumer and Capital Spend Driven Innovation Propel China Forward?" Featuring: Malcolm Dorson, Head

INVESTMENT WARS: CHINA, INNOVATION AND YIELD CURVE TEASER

September 13, 2023

After a breather taken during August we are excited about the upcoming podcasts we plan to publish discussing how the

LEVERAGING STRATEGIC PARTNERSHIPS TO BOLSTER YOUR RIA BUSINESS

September 12, 2023

As a Registered Investment Advisor (RIA), delivering exceptional financial advice and services to your clients is paramount. However, growing and

MARKET COMMENTARY: WHAT IS GOING ON IN CHINA?

September 8, 2023

The China – US relationship used to be quite simple: China produced anything and everything we wanted, cheaply and well-made.

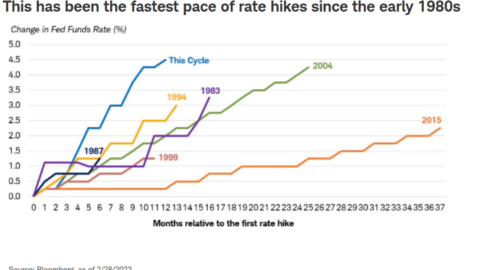

INVESTMENT WARS: HOW DO HIGHER RATES AFFECT THE ECONOMY AND MARKET?

August 9, 2023

Debate: "How Do Higher Rates Affect the Economy and Market?" Featuring: Bob Grunewald, CEO & Founder of Flat Rock Global,

EMBRACING OUTSOURCING: A TRANSPARENT CONVERSATION WITH YOUR CLIENTS

August 8, 2023

As a financial advisor, your primary goal is to provide the best possible service to your clients, ensuring their financial

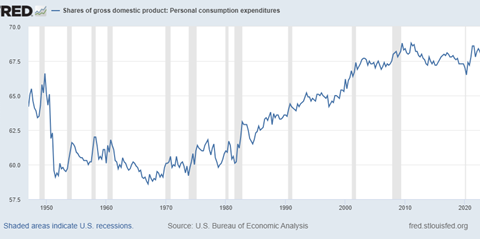

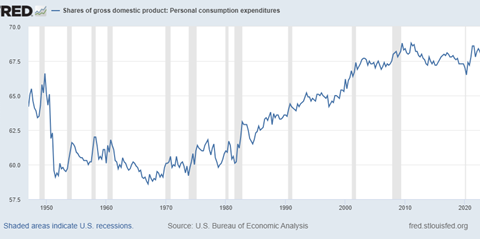

MARKET COMMENTARY: HOW IS THE CONSUMER DOING AND IMPLICATIONS FOR THE ECONOMY

August 7, 2023

As the consumer goes, so goes the economy. A lot of attention has been justifiably spent on inflation, corporate health,

INVESTMENT WARS: THE RESILIENCE OF THE 60/40 PORTFOLIO

July 19, 2023

Debate: "The Resilience of the 60/40 Portfolio" Featuring Chris Tidmore, Senior Manager for the Vanguard Investment Advisory Research Center. The

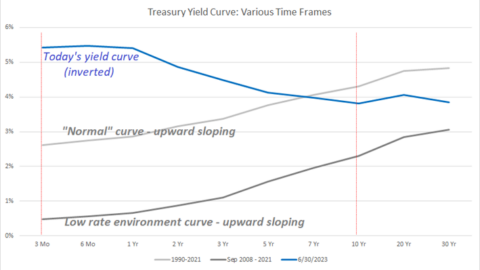

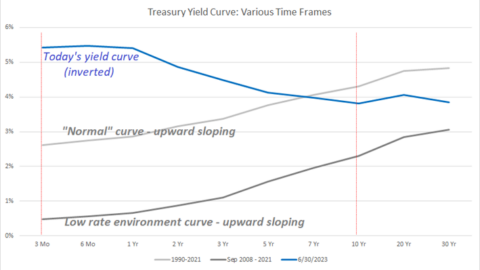

MARKET COMMENTARY: INVERTED YIELD CURVE: BUSINESS AFFECTS AND RECESSIONARY RECORD

July 10, 2023

Ever wonder how a yield on a loan is determined? Let’s say my neighbor thinks he has the best business

A STRATEGIC APPROACH TO TAX OPTIMIZATION

July 5, 2023

Taxes are typically a client’s largest or second largest expense. In response to this fact, it is imperative that financial

INVESTMENT WARS: WILL WE HAVE A HARD LANDING?

June 21, 2023

Debate: “Will We Have a Hard Landing?” Featuring Matthew Miskin, Co-Chief Investment Strategist at John Hancock Investment Management. We have

A BETTER APPROACH TO REBALANCING

June 9, 2023

Rebalancing is a cornerstone of the wealth management industry. It allows advisors to manage risk, capitalize on market opportunities, and

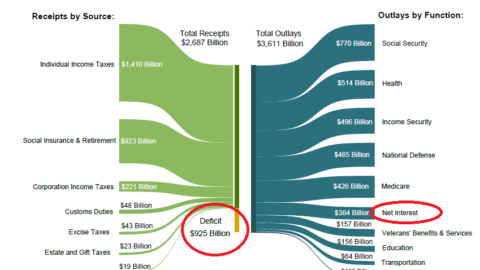

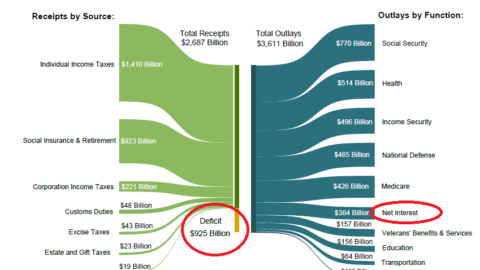

INVESTMENT WARS: US DEBT LEVELS ARE TOO HIGH

June 7, 2023

Debate: “US Debt Levels are Too High” Featuring Matt Orton, Head of Advisory Solutions and Market Strategy at Raymond James

MARKET COMMENTARY: ARE US DEBT LEVELS TOO HIGH?

June 5, 2023

The United States has thankfully diverted a default by raising our debt limit. Our national debt stood at $31.4 trillion,

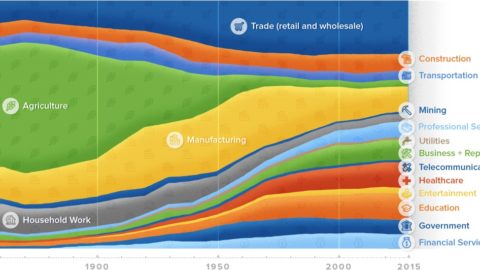

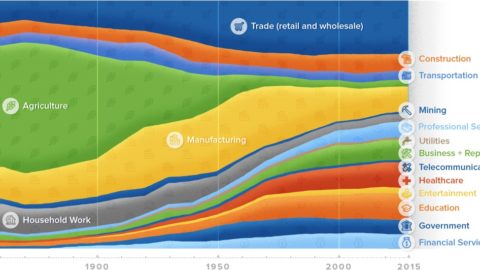

INVESTMENT WARS: FUTURE OF JOBS

May 17, 2023

Debate: “Wage Inflation Will Increase for the Foreseeable Future Due to a Tight Supply of Workers” Featuring Jeremie Capron, Director

FOUNTAINHEAD ASSET MANAGEMENT LAUNCHES DYNAMIC REBALANCING FEATURE

May 8, 2023

This cutting-edge capability is customizable to meet each client’s specific investment objectives and risk tolerance.

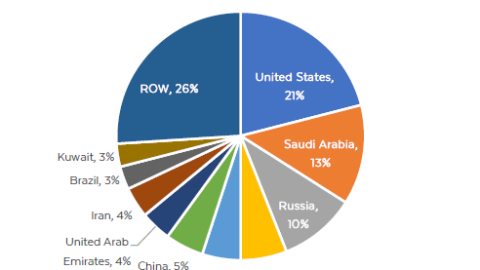

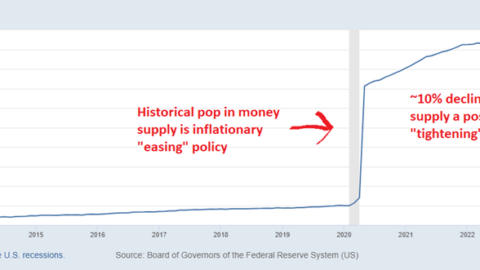

MARKET COMMENTARY: DE-DOLLARIZATION, DEBT DEFAULTS AND OTHER DIFFICULTIES

May 8, 2023

A new world order was established with the conclusion of World War II (“WW II”), with America firmly set as

FOUNTAINHEAD ASSET MANAGEMENT PARTNERS WITH NYFTY WEALTH

April 27, 2023

Fountainhead Asset Management (“FAM”) is excited to announce a new partnership with Nyfty Wealth (“Nyfty”).

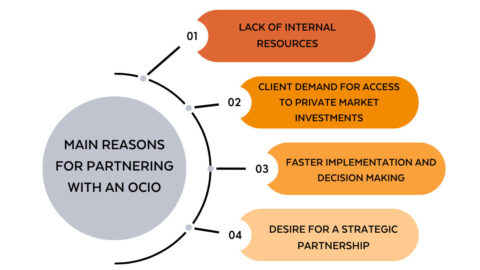

A DEEP DIVE INTO THE WORLD OF OUTSOURCED CHIEF INVESTMENT OFFICERS

April 25, 2023

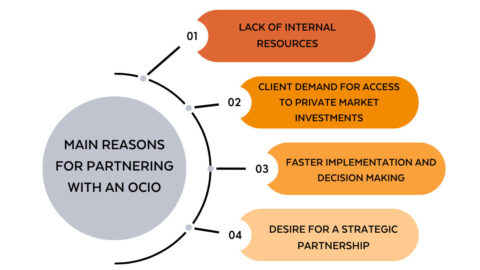

HOW PARTNERING WITH AN OCIO ALLOWS ADVISORS TO BETTER SERVE TODAY’S HIGH NET WORTH INVESTORS The concept of using an

INVESTMENT WARS: DEMOGRAPHICS – AGING OF US / DEVELOPED MARKETS WILL CAUSE DEFLATION

April 24, 2023

Debate: “Aging of the US Population Will Cause Deflation” Featuring Brian LoDestro, Senior Portfolio Strategist at PGIM Fixed Income, and

MARKET COMMENTARY: BANK RUNS – MORE TO COME OR DISASTER AVERTED?

April 12, 2023

In one of the largest heists in history, Sir Francis Drake circumnavigated South America in the late 1570s and stole

HOW DOES AN OCIO COMPARE TO A TAMP?

April 6, 2023

COMPARING OCIOS VS. TAMPS The marketplace for outsourced investment solutions can be a very confusing place. In an industry that

INVESTMENT WARS: DEBATE ON INFLATION

March 30, 2023

Introducing...Investment Wars! Our inaugural episode features Meera Pandit, Executive Director, Global Market Strategist at J.P. Morgan Asset Management & Lara

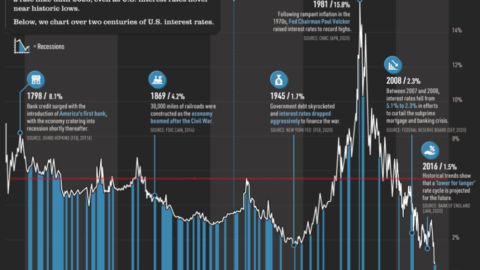

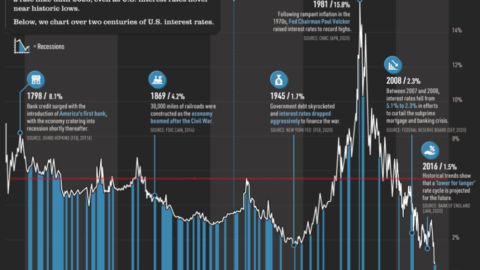

MARKET COMMENTARY: ARE BOND YIELDS FINALLY GETTING INTERESTING? A HISTORICAL PERSPECTIVE

March 7, 2023

When Paul Volcker took over as Fed Chair on August 6, 1979, he meant business. Two months later Mr. Volcker

RIA PRACTICES: WHAT’S YOUR ALTERNATIVE?

February 28, 2023

3 STRATEGIES FOR RIA PRACTICES TO DIFFERENTIATE AND WIN MORE CLIENTS IN 2023 While there is a rise in demand

MARKET COMMENTARY: SILLY PREDICTIONS, REASONABLE TRENDS AND SHORT-TERM RISKS

February 2, 2023

Moore’s Law was actually a prediction, not a law as we tend to think of them. The long-term prediction was

WHAT’S YOUR MOVE FOR 2023?

January 27, 2023

3 Signs It’s Time to Become an Independent RIA As we kick off a new year, many financial advisors take

MARKET COMMENTARY: HOW YIELDS AFFECT LITERALLY EVERYTHING

January 17, 2023

One of the prevailing investment themes of 2022 was rising interest rates, and their impact on financial markets. To put

FOUNTAINHEAD ASSET MANAGEMENT PARTNERS WITH VALOR INVESTMENTS & PLANNING

December 21, 2022

Valor Investments & Planning (“Valor”) has combined forces with Fountainhead Asset Management (“FAM”).

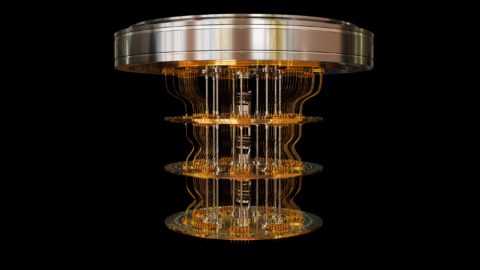

MARKET COMMENTARY: THE COMPLEXITIES OF INNOVATION: FTX VS. QUANTUM COMPUTING

December 5, 2022

The spectacular descent of once prominent companies can surely grab media headlines and investor attention. Fraudulent blowups like Theranos and

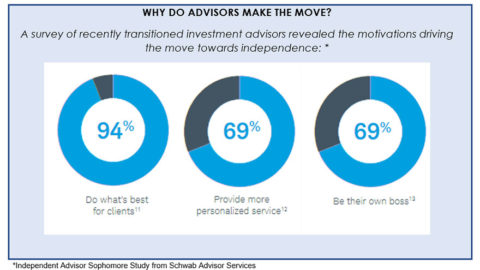

WHEN DO ADVISORS BREAKAWAY TO BECOME INDEPENDENT?

November 18, 2022

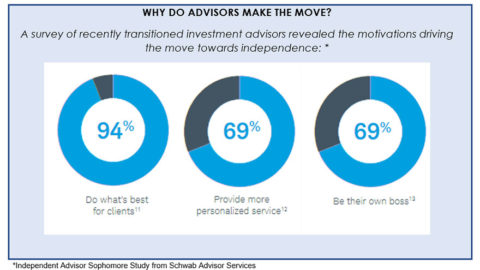

AS THE RIA MODEL CONTINUES TO GROW, HOW DO ADVISORS DETERMINE WHEN TO BECOME INDEPENDENT? Over 90% of advisors who

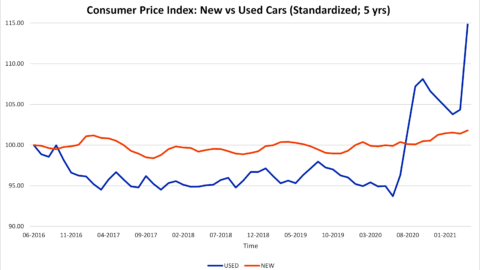

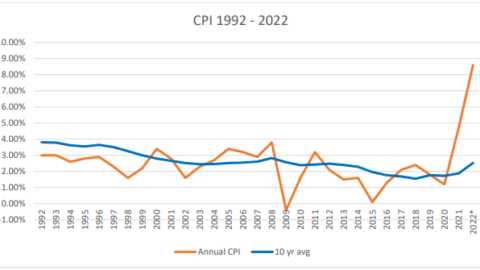

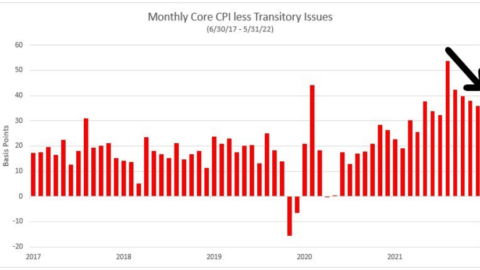

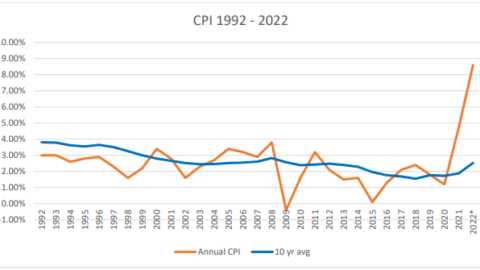

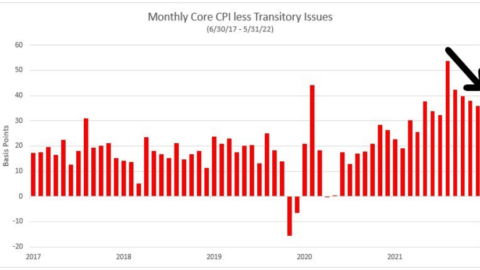

MARKET COMMENTARY: CPI – SAME DATA THROUGH THREE DIFFERENT LENSES

November 7, 2022

Our analyst team was on a call recently where a well-respected (to us) manager thought inflation would remain heightened because

THE RIA PATH TO INDEPENDENCE

October 10, 2022

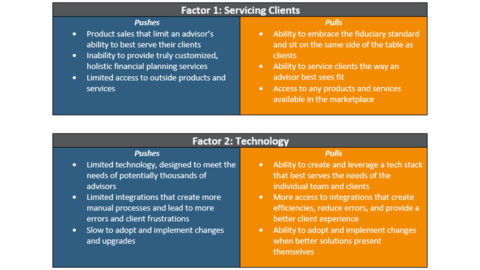

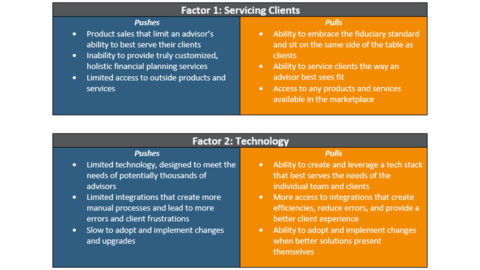

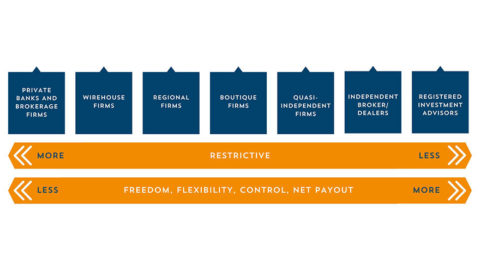

FOR ADVISORS WHO HAVE CHOSEN TO MOVE TOWARDS INDEPENDENCE, NOW WHAT? RIA firms represent the fastest growing category in the

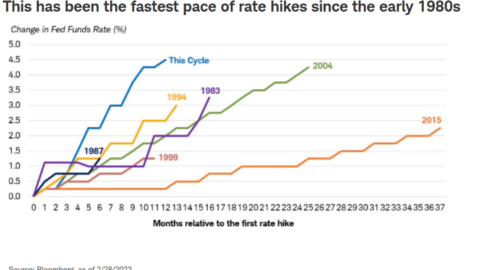

MARKET COMMENTARY: MAKING SENSE OF INFLATION, FED TIGHTENING, AND GEOPOLITICS

October 5, 2022

The Fed is attempting to knock down inflation – and there are signs that it is beginning to work –

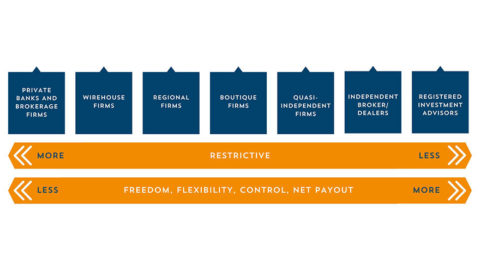

TODAY’S FINANCIAL ADVISOR SPECTRUM OF INDEPENDENCE: ADVANTAGES OF REGISTERED INVESTMENT ADVISORS (RIAS)

September 15, 2022

WHY FINANCIAL ADVISORS ARE TRANSITIONING TO RIAS The wealth management industry has evolved dramatically since its inception over 40 years

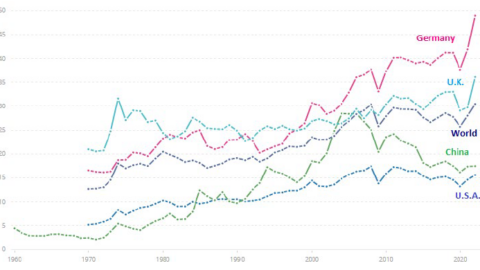

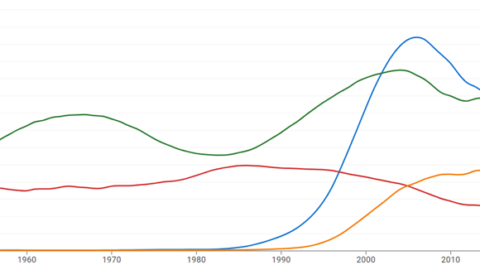

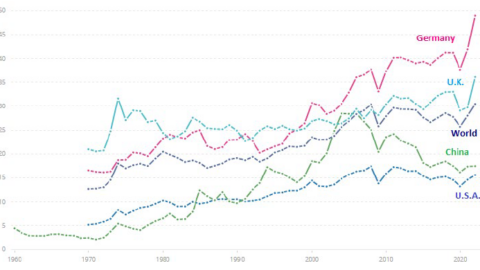

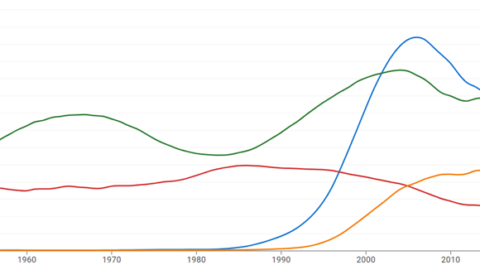

MARKET COMMENTARY: THE LONGER-TERM RHYTHM AND CONSEQUENCES OF GLOBALIZATION

September 7, 2022

Globalization as we know it seemed to have hit its peak around a decade ago. Global trade as a percentage

SELF-ASSESS TO SUCCESS! PART II: DO IT OR DELEGATE IT WITHIN YOUR FINANCIAL ADVISORY PRACTICE?

August 17, 2022

When Financial Advisory Practices Should Outsource or Hire As discussed in Self-Assess to Success! Part I: You Can't Manage What

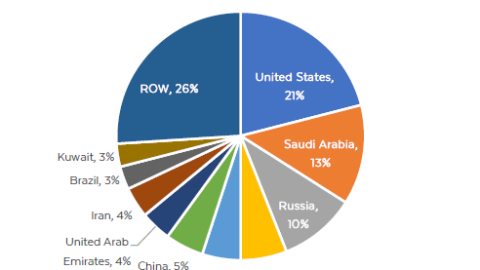

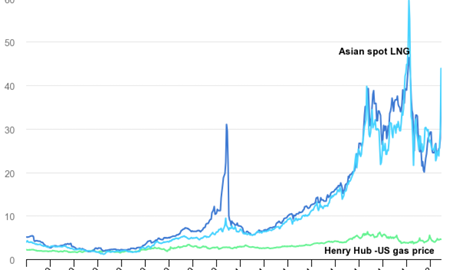

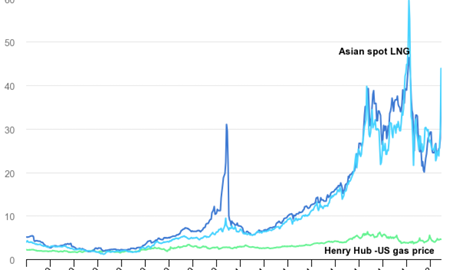

MARKET COMMENTARY: WHY (AND HOW) ARE GAS PRICES DOWN?

August 8, 2022

On June 14, the national average for regular unleaded gas was $5.016 per gallon. As of August 1, the average

SELF-ASSESS TO SUCCESS! PART I: YOU CAN’T MANAGE WHAT YOU DON’T MEASURE*

July 19, 2022

Successful Financial Advisors Self-Assess to Grow Their Practice At some point in your career as an independent financial advisor, you

MARKET COMMENTARY: MENTAL GYMNASTICS

July 18, 2022

The mind is a powerful thing. We have heard the saying, we know it to be true, and we can

MID-MONTH MARKET COMMENTARY: A THREE-DAY 10%+ DROP… A U.S. BEAR MARKET… WHERE ARE WE NOW?

June 17, 2022

A surprise European Central Bank interest rate hike followed by a “bad” print on a closely watched inflation gauge created

THE MODERN ADVISORY PRACTICE: IF YOU BUILD IT, WILL THEY COME?

June 12, 2022

Learning from Modern Advisory Practices of Dreams “If you build it, he will come.” The famous quote from the 1989

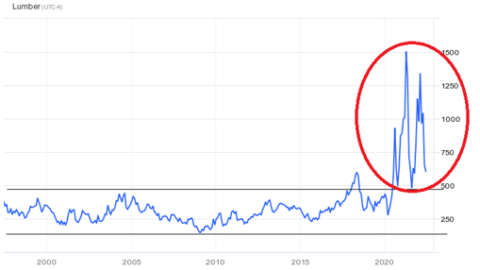

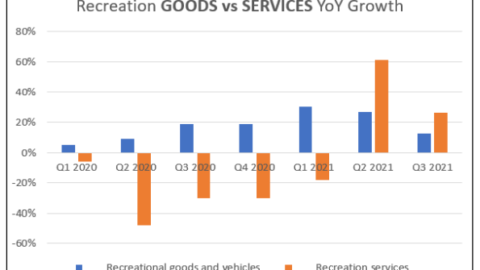

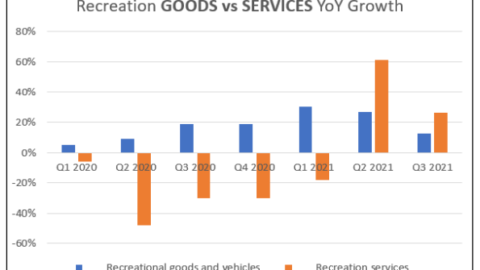

MARKET COMMENTARY: HOW LONG WILL WE FEEL COVID REVERBERATIONS?

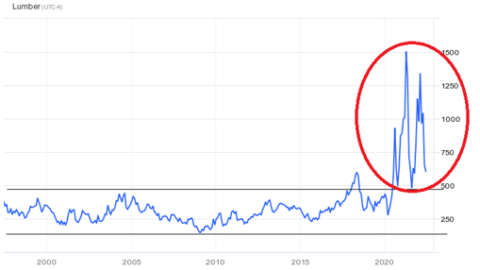

June 6, 2022

Throw a pebble in a still lake and you create a ripple. As one moves further from the center, the

WILL MARKET VOLATILITY LEAD TO AN ADVISORY PRACTICE RECESSION?

May 23, 2022

Understanding the Impact of Market Volatility In November 2020, a Business Insider headline read, “The stock market will surge 26%

MARKET COMMENTARY: ‘40S OR ‘70S – WHAT’S THE BETTER COMPARISON?

May 6, 2022

It was late 1940, some of the darkest days of the war for Great Britain. The Luftwaffe was indiscriminately bombing

FAM ANNOUNCES KERI KUTAKOFF AS CHIEF OPERATING OFFICER

April 25, 2022

Fountainhead is pleased to announce Keri Kutakoff has been appointed to fulfill the new role of Chief Operating Officer (COO)

MARKET COMMENTARY: INFLATION, INVASION, INNOVATION!

April 16, 2022

In Smokey and the Bandit, Burt Reynolds wins a challenge by illegally taking alcohol over state lines in a big

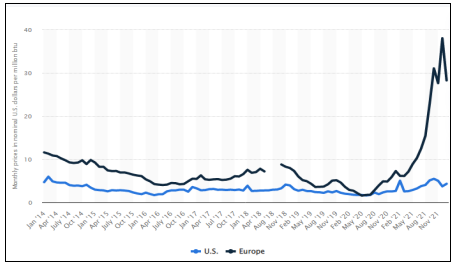

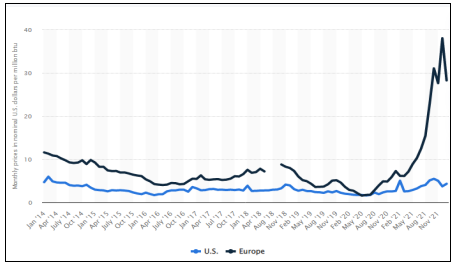

MARKET COMMENTARY: FINANCIAL IMPLICATIONS OF THE RUSSIAN INVASION OF UKRAINE

March 4, 2022

First, our hearts go out to the 40 million plus citizens of Ukraine. It is impossible to imagine or feel

FOUNTAINHEAD ASSET MANAGEMENT PARTNERS WITH AUGULIS FINANCIAL FIRM

February 18, 2022

Fountainhead Asset Management (“FAM”) is proud to welcome Augulis Financial Firm, LLC (“Augulis”) to its platform.

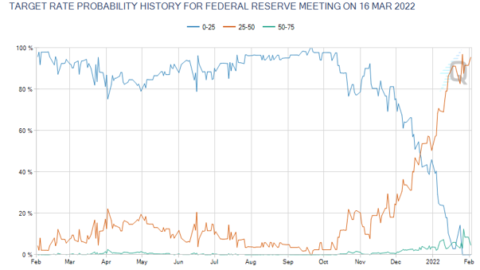

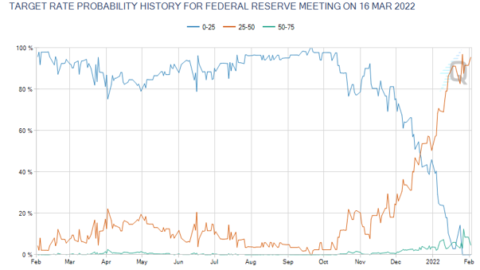

MARKET COMMENTARY: READJUSTING THE LENS IN LOOKING PAST CURRENT MARKET HEADWINDS

February 4, 2022

The market has become quite complicated lately, with several negative events coming to the forefront of investors’ focus, muddling the

MARKET COMMENTARY: WHERE ARE WE GOING? DISRUPTION, UPHEAVAL, INNOVATION!

January 14, 2022

A front-line chicken processing plant job is among the less desirable positions available. One must stand all day on an

MARKET COMMENTARY: SUPPLY CHAIN TRAFFIC SNARL EXPLAINED

December 3, 2021

The global supply chain has been built over the course of the last few decades to maximize profit through providing

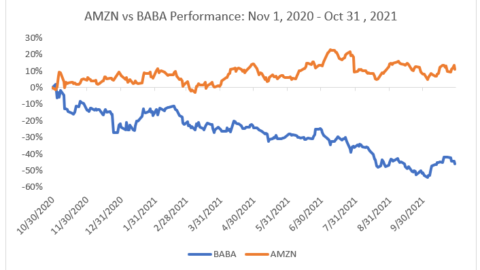

MARKET COMMENTARY: MAKING SENSE OF CHINA: BUY OR SELL?

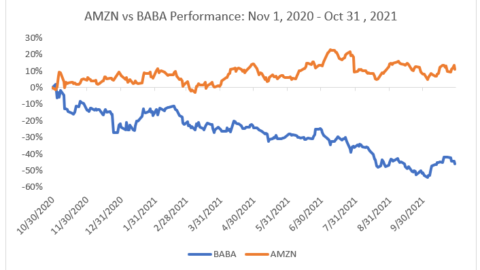

November 5, 2021

Alibaba (BABA), a Chinese company primarily focused on e-commerce, is frequently compared to Amazon (AMZN), an American company with a

ADVISOR COACHING CALL WITH MICHAEL SILVER

October 29, 2021

For this Advisor Coaching Call we will be discussing how to Segment Your Book to SCALE Your Business.

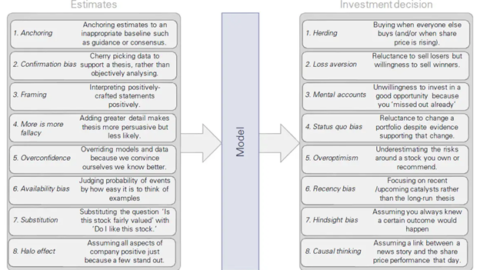

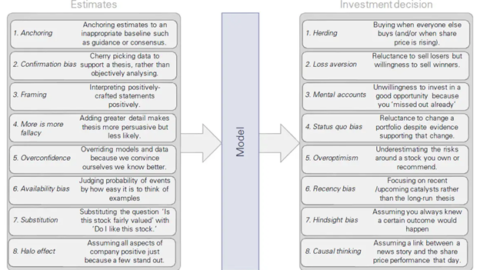

HOW DO COGNITIVE BIASES LEAD TO INVESTMENT MISTAKES?

October 22, 2021

Featuring Dr. Brooke Struck, Research Director at The Decision Lab.

MARKET COMMENTARY: RECOGNIZING AND COMBATTING BIASES IN INVESTING

October 15, 2021

True story: A father and son are caught stealing a TV. There is no question they did it. The father

ADVISOR COACHING CALL WITH MICHAEL SILVER

September 21, 2021

For this first installment of our monthly coaching call with Michael Silver, we will be discussing Value Proposition & your

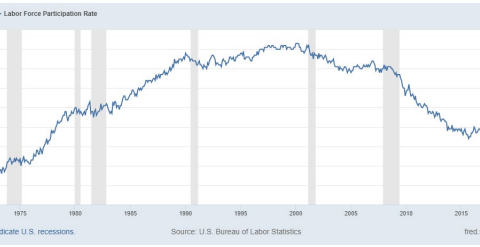

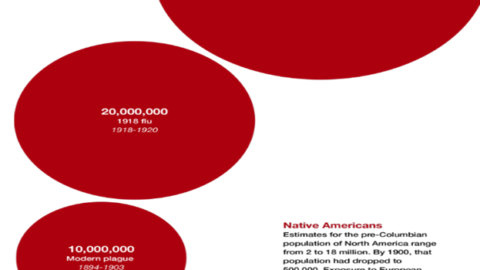

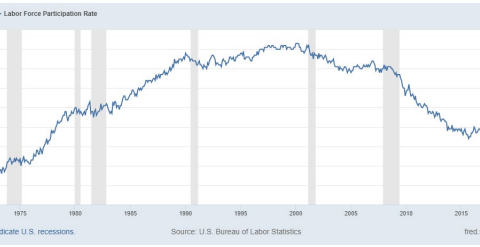

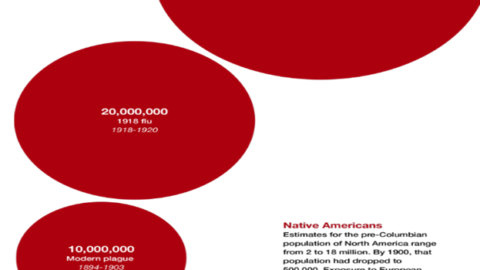

MARKET COMMENTARY: JOBS – ALL-TIME HIGH JOB OPENINGS VS ALL-TIME LOW JOB PARTICIPATION: WHAT GIVES?

September 3, 2021

Serfdom in Europe was destroyed by the Plague. It was destroyed because there were too few serfs to do the

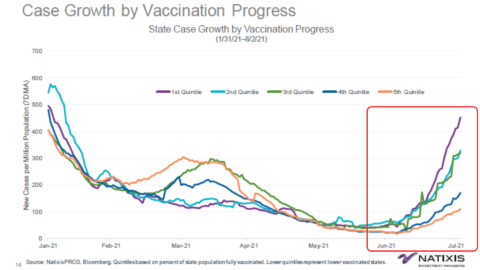

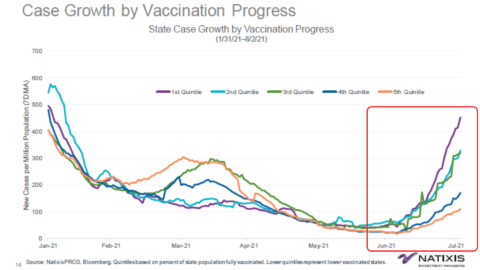

MARKET COMMENTARY: WHAT DELTA MEANS FOR THE MARKET

August 6, 2021

New cases of Covid have unfortunately increased over the last few weeks as the Delta variant has become the dominant

MARKET COMMENTARY: HOW DO MARKETS REALLY WORK?

July 15, 2021

It’s always a bit scary when going onto one of those travel sites, like Expedia, with the goal of booking

PROSPECT OR DIE

July 8, 2021

“If you’re not prospecting, you’re dying.” While a bit bold, that one liner mentioned in a recent Fountainhead sponsored webinar

MARKETING IDEAS FOR FINANCIAL ADVISORS

June 29, 2021

Where to next? The road to recovery has begun...how are you rethinking your marketing and investment strategy? For many Advisors, marketing activities

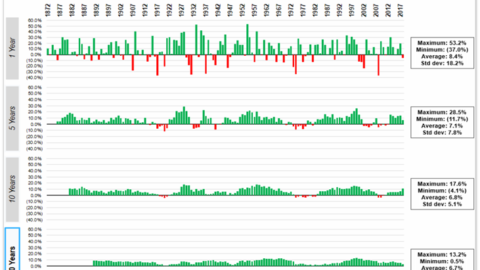

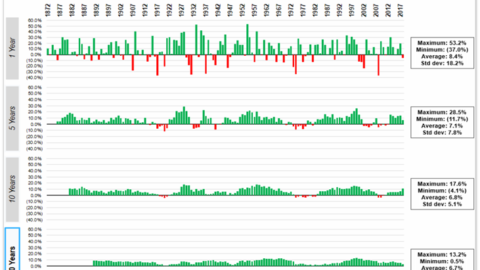

MARKET COMMENTARY: TIMING THE TOP

May 12, 2021

In one of our first Explorations we had shared the following chart which illustrates that, at least historically, the longer

MARKET COMMENTARY: DECLINING PRODUCTIVITY?

April 28, 2021

How exactly is productivity defined and why has it been so lackluster as of late?

DECLINING PRODUCTIVITY?

April 26, 2021

Featuring Dr. Jessica Hirsh Weiss, Co-founder & Director, Grand Central Psychology

UGLY DUCKLING OR SWAN?

April 8, 2021

Uncover opportunity via single client review and quickly apply to select Investment Models

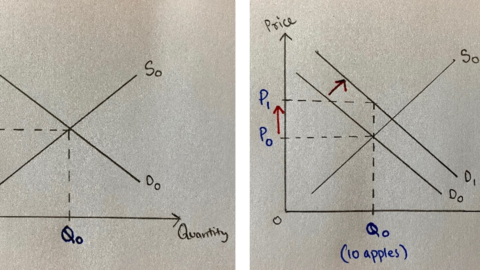

MARKET COMMENTARY: EXUBERANCE? MANIA? OUR TAKES ON GAMESTOP, DOGECOIN & SPACS

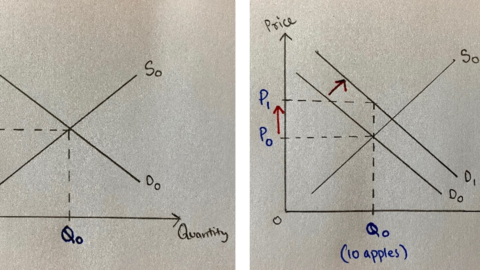

February 1, 2021

The first thing one learns in Economics is the Supply & Demand curve. It is so simple yet so powerful

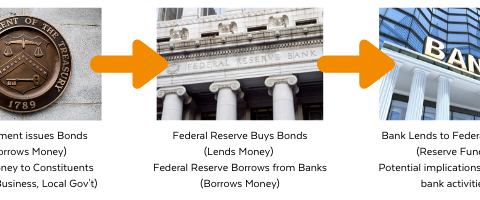

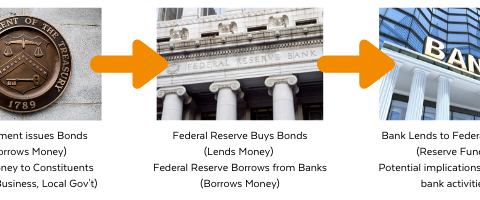

MARKET COMMENTARY: THE US TREASURY -FEDERAL RESERVE CONNECTION & ASSOCIATED IMPLICATIONS

January 1, 2021

Janet Yellen has made history. She is now the only person to serve as both the head of the Federal

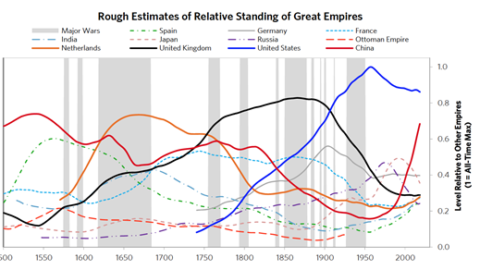

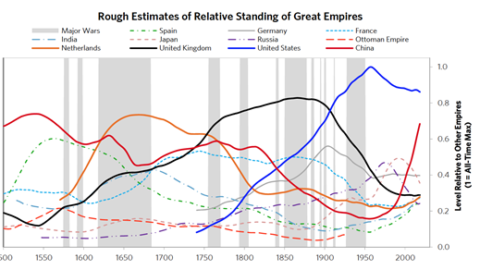

MARKET COMMENTARY: Is Our Empire Crumbling?

December 15, 2020

Immediately following the end of World War II, the US dominated as no empire had in the history of empires.

MARKET COMMENTARY: SOCIAL CHANGES, LOW YIELDS &THE EFFECTS ON GROWTH STOCKS

November 1, 2020

Thank God for technology. My children can attend school, socialize with friends, and waste away their days watching an infinite

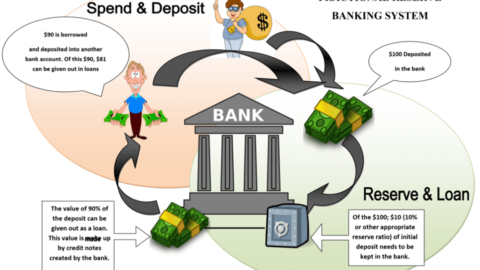

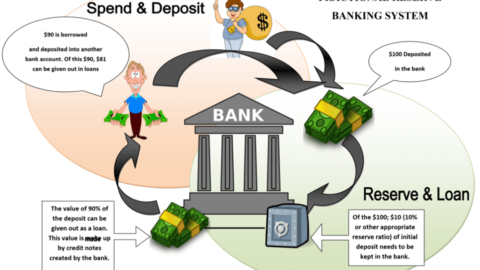

MARKET COMMENTARY: MONEY! WEALTH’S GREATEST CREATION

October 9, 2020

Money is a human convention. Populations need to be convinced one way or another that currency has value.

MARKET COMMENTARY: COVID TIMELINE AND IMPLICATIONS

October 1, 2020

The good news is that 2020 is almost over. The bad news is that calendars are a human convention and

MARKET COMMENTARY: IS THE US MONEY GOOD?

August 26, 2020

America shut down for business rather quickly once it was evident that COVID was on our shores.

MARKET COMMENTARY: TESLA –OPPORTUNITY OR BUBBLE?

August 1, 2020

Tesla is a hot name for good reason. They are changing the world and hopefully for the better. They are

MARKET COMMENTARY: MARKET RISK DUE ELECTIONS (DELAY/FRAUD ACCUSACTIONS) MATERIAL

July 1, 2020

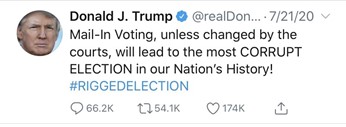

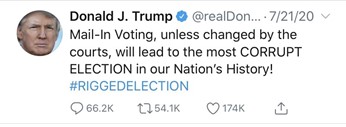

Over the last 10 days of July, President Trump warned 6 times that the election would be inaccurate and fraudulent

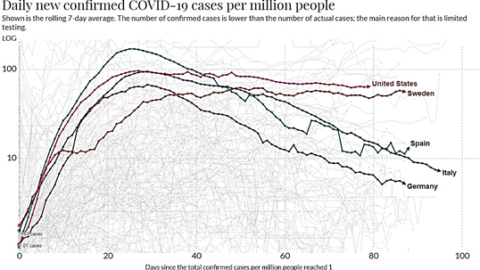

MARKET COMMENTARY: ARE WE SWEDEN? CONTINUED COVID = ELECTION RISK

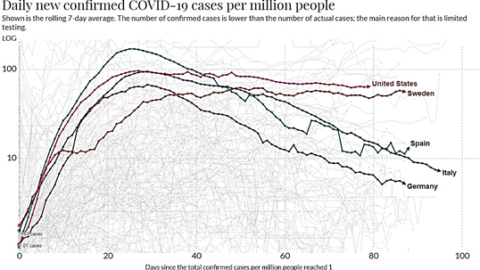

May 1, 2020

After a ho-hum start, 2020 is turning out to be a historical year. Possibly one talked about for a long

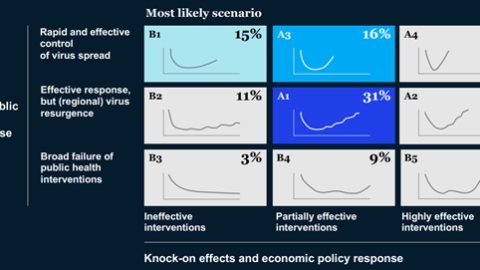

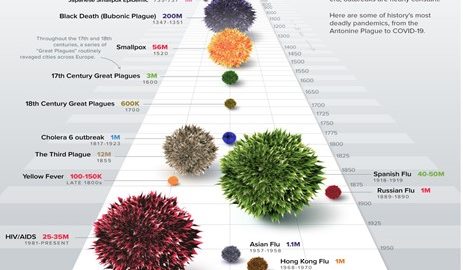

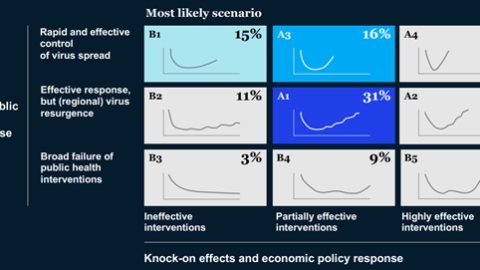

MARKET COMMENTARY: IS THE PUBLIC HEALTH AND ECONOMIC POLICY RESPONSE ADEQUATE?

April 1, 2020

Dring up Avenue of the Americas there is no traffic, almost no people beyond sporadic groups waiting on food lines

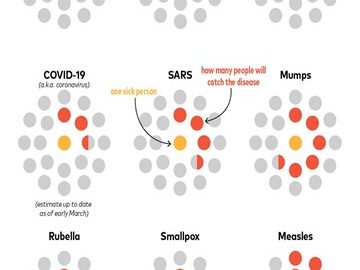

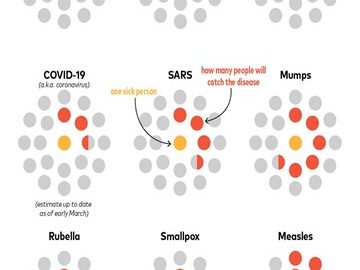

MARKET COMMENTARY: COVID-19 (CORONAVIRUS): CURRENT AND FUTURE IMPLICATIONS

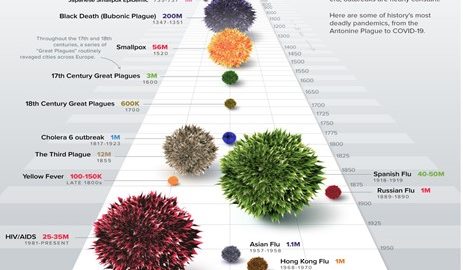

April 1, 2020

COVID-19 (Coronavirus): Current and Future Implication

COVID-19 (CORONAVIRUS) UPDATE

February 25, 2020

On Monday, February 24, world markets took a large one day hit due to fears that COVID-19 would become a

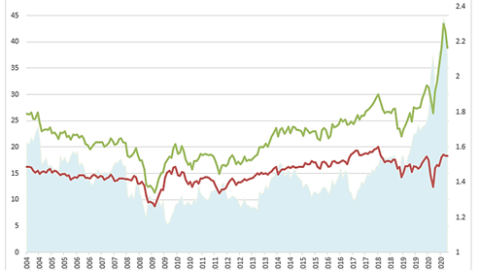

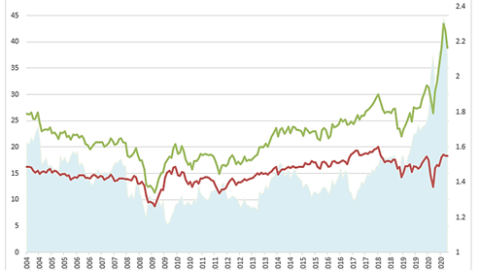

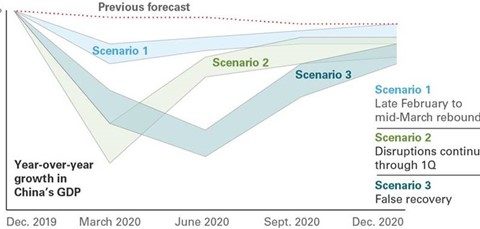

MARKET COMMENTARY: COMPANY VALUATIONS IN CONTEXT TO COVID-19

February 1, 2020

Having issued a COVID-19 Update just last week and with everyone in the world laser-focused on the spread and immediate

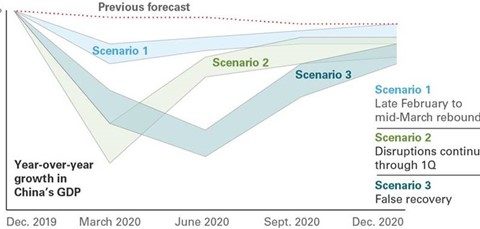

MARKET COMMENTARY: LONGER TERM EFFECTS OF THE VIRUS AND HOW FAR WE HAVE COME

January 1, 2020

Will the Coronavirus have the ability to trigger a global economic slowdown resulting in a dip in financial markets?

Advisor Insights

EMPOWERING FINANCIAL PLANNERS: HOW AN OCIO ENHANCES AN RIA’S VALUE PROPOSITION

November 30, 2023

Registered Investment Advisor (RIA) firms whose primary value proposition is providing comprehensive financial planning services have an opportunity to significantly

ADVANTAGES OF HIRING AN OCIO OVER AN IN-HOUSE CIO: ELEVATING INVESTMENT MANAGEMENT FOR RIAS

October 30, 2023

As a Registered Investment Advisor (RIA) firm begins to build and grow, one of the many significant decisions they face

THE DOWNSIDES OF AN RIA MANAGING THEIR OWN PORTFOLIOS

October 4, 2023

What RIAs are Risking by Self-Managing Client Portfolios As a Registered Investment Advisor (RIA), providing investment management of client portfolios

LEVERAGING STRATEGIC PARTNERSHIPS TO BOLSTER YOUR RIA BUSINESS

September 12, 2023

As a Registered Investment Advisor (RIA), delivering exceptional financial advice and services to your clients is paramount. However, growing and

EMBRACING OUTSOURCING: A TRANSPARENT CONVERSATION WITH YOUR CLIENTS

August 8, 2023

As a financial advisor, your primary goal is to provide the best possible service to your clients, ensuring their financial

A STRATEGIC APPROACH TO TAX OPTIMIZATION

July 5, 2023

Taxes are typically a client’s largest or second largest expense. In response to this fact, it is imperative that financial

A BETTER APPROACH TO REBALANCING

June 9, 2023

Rebalancing is a cornerstone of the wealth management industry. It allows advisors to manage risk, capitalize on market opportunities, and

A DEEP DIVE INTO THE WORLD OF OUTSOURCED CHIEF INVESTMENT OFFICERS

April 25, 2023

HOW PARTNERING WITH AN OCIO ALLOWS ADVISORS TO BETTER SERVE TODAY’S HIGH NET WORTH INVESTORS The concept of using an

HOW DOES AN OCIO COMPARE TO A TAMP?

April 6, 2023

COMPARING OCIOS VS. TAMPS The marketplace for outsourced investment solutions can be a very confusing place. In an industry that

RIA PRACTICES: WHAT’S YOUR ALTERNATIVE?

February 28, 2023

3 STRATEGIES FOR RIA PRACTICES TO DIFFERENTIATE AND WIN MORE CLIENTS IN 2023 While there is a rise in demand

WHAT’S YOUR MOVE FOR 2023?

January 27, 2023

3 Signs It’s Time to Become an Independent RIA As we kick off a new year, many financial advisors take

WHEN DO ADVISORS BREAKAWAY TO BECOME INDEPENDENT?

November 18, 2022

AS THE RIA MODEL CONTINUES TO GROW, HOW DO ADVISORS DETERMINE WHEN TO BECOME INDEPENDENT? Over 90% of advisors who

THE RIA PATH TO INDEPENDENCE

October 10, 2022

FOR ADVISORS WHO HAVE CHOSEN TO MOVE TOWARDS INDEPENDENCE, NOW WHAT? RIA firms represent the fastest growing category in the

TODAY’S FINANCIAL ADVISOR SPECTRUM OF INDEPENDENCE: ADVANTAGES OF REGISTERED INVESTMENT ADVISORS (RIAS)

September 15, 2022

WHY FINANCIAL ADVISORS ARE TRANSITIONING TO RIAS The wealth management industry has evolved dramatically since its inception over 40 years

SELF-ASSESS TO SUCCESS! PART II: DO IT OR DELEGATE IT WITHIN YOUR FINANCIAL ADVISORY PRACTICE?

August 17, 2022

When Financial Advisory Practices Should Outsource or Hire As discussed in Self-Assess to Success! Part I: You Can't Manage What

SELF-ASSESS TO SUCCESS! PART I: YOU CAN’T MANAGE WHAT YOU DON’T MEASURE*

July 19, 2022

Successful Financial Advisors Self-Assess to Grow Their Practice At some point in your career as an independent financial advisor, you

THE MODERN ADVISORY PRACTICE: IF YOU BUILD IT, WILL THEY COME?

June 12, 2022

Learning from Modern Advisory Practices of Dreams “If you build it, he will come.” The famous quote from the 1989

WILL MARKET VOLATILITY LEAD TO AN ADVISORY PRACTICE RECESSION?

May 23, 2022

Understanding the Impact of Market Volatility In November 2020, a Business Insider headline read, “The stock market will surge 26%

Press Releases

INVESTMENT WARS: WILL THE FED REALLY CUT RATES THREE TIMES THIS YEAR?

April 5, 2024

Debate: Will the Fed Really Cut Rates Three Times this Year? Featuring: Michael Shaoul, Chairman, Portfolio Manager and CEO of

FOUNTAINHEAD ASSET MANAGEMENT LAUNCHES DYNAMIC REBALANCING FEATURE

May 8, 2023

This cutting-edge capability is customizable to meet each client’s specific investment objectives and risk tolerance.

FOUNTAINHEAD ASSET MANAGEMENT PARTNERS WITH NYFTY WEALTH

April 27, 2023

Fountainhead Asset Management (“FAM”) is excited to announce a new partnership with Nyfty Wealth (“Nyfty”).

FOUNTAINHEAD ASSET MANAGEMENT PARTNERS WITH VALOR INVESTMENTS & PLANNING

December 21, 2022

Valor Investments & Planning (“Valor”) has combined forces with Fountainhead Asset Management (“FAM”).

FAM ANNOUNCES KERI KUTAKOFF AS CHIEF OPERATING OFFICER

April 25, 2022

Fountainhead is pleased to announce Keri Kutakoff has been appointed to fulfill the new role of Chief Operating Officer (COO)

FOUNTAINHEAD ASSET MANAGEMENT PARTNERS WITH AUGULIS FINANCIAL FIRM

February 18, 2022

Fountainhead Asset Management (“FAM”) is proud to welcome Augulis Financial Firm, LLC (“Augulis”) to its platform.

From the Desk of Our CIO

MARKET COMMENTARY: THE EFFECTS OF ONSHORING ON THE US AND ITS CONSUMERS

April 8, 2024

We are a consumer-led economy. And boy, do we do a good job consuming! As of 2022, the United States

MARKET COMMENTARY: GLOBAL TREMORS: OPTIMISM AND CONCERNS

March 8, 2024

On a recent international trip, I watched Golda and All the President’s Men, two movies based on historical events that

MARKET COMMENTARY: VALUE, TRUST, BITCOIN & HUMAN INGENUITY

February 5, 2024

I remember visiting my uncle’s house in the early ‘90s and watching with fascination as my cousin, 15 years younger,

MARKET COMMENTARY: INFLATION: LOCAL AND GLOBAL FACTORS – WHAT IS IN STORE FOR 2024

January 5, 2024

Mongol Empire Khagan-Emperor Kublai Kahn wanted to be more like his dad and grandpa, Genghis Khan, spurring on wars that

MARKET COMMENTARY: GLOBALIZATION, WAR, AND INFLATION

December 11, 2023

There has always been “international” trade of physical goods, knowledge, and concepts. Just two famous examples are the great library

MARKET COMMENTARY: RECESSIONARY WINDS

November 6, 2023

The job of the Federal Reserve (“Fed”) is to maintain a healthy and stable economy and financial system. Generally speaking,

MARKET COMMENTARY: EXPENSIVE HOUSING AND POTENTIAL CONSEQUENCES

October 6, 2023

The average purchase of a residential dwelling in the US consists of 20% down and 80% in loans[1], typically taken

MARKET COMMENTARY: WHAT IS GOING ON IN CHINA?

September 8, 2023

The China – US relationship used to be quite simple: China produced anything and everything we wanted, cheaply and well-made.

MARKET COMMENTARY: HOW IS THE CONSUMER DOING AND IMPLICATIONS FOR THE ECONOMY

August 7, 2023

As the consumer goes, so goes the economy. A lot of attention has been justifiably spent on inflation, corporate health,

MARKET COMMENTARY: INVERTED YIELD CURVE: BUSINESS AFFECTS AND RECESSIONARY RECORD

July 10, 2023

Ever wonder how a yield on a loan is determined? Let’s say my neighbor thinks he has the best business

MARKET COMMENTARY: ARE US DEBT LEVELS TOO HIGH?

June 5, 2023

The United States has thankfully diverted a default by raising our debt limit. Our national debt stood at $31.4 trillion,

MARKET COMMENTARY: DE-DOLLARIZATION, DEBT DEFAULTS AND OTHER DIFFICULTIES

May 8, 2023

A new world order was established with the conclusion of World War II (“WW II”), with America firmly set as

MARKET COMMENTARY: BANK RUNS – MORE TO COME OR DISASTER AVERTED?

April 12, 2023

In one of the largest heists in history, Sir Francis Drake circumnavigated South America in the late 1570s and stole

MARKET COMMENTARY: ARE BOND YIELDS FINALLY GETTING INTERESTING? A HISTORICAL PERSPECTIVE

March 7, 2023

When Paul Volcker took over as Fed Chair on August 6, 1979, he meant business. Two months later Mr. Volcker

MARKET COMMENTARY: SILLY PREDICTIONS, REASONABLE TRENDS AND SHORT-TERM RISKS

February 2, 2023

Moore’s Law was actually a prediction, not a law as we tend to think of them. The long-term prediction was

MARKET COMMENTARY: HOW YIELDS AFFECT LITERALLY EVERYTHING

January 17, 2023

One of the prevailing investment themes of 2022 was rising interest rates, and their impact on financial markets. To put

MARKET COMMENTARY: THE COMPLEXITIES OF INNOVATION: FTX VS. QUANTUM COMPUTING

December 5, 2022

The spectacular descent of once prominent companies can surely grab media headlines and investor attention. Fraudulent blowups like Theranos and

MARKET COMMENTARY: CPI – SAME DATA THROUGH THREE DIFFERENT LENSES

November 7, 2022

Our analyst team was on a call recently where a well-respected (to us) manager thought inflation would remain heightened because

MARKET COMMENTARY: MAKING SENSE OF INFLATION, FED TIGHTENING, AND GEOPOLITICS

October 5, 2022

The Fed is attempting to knock down inflation – and there are signs that it is beginning to work –

MARKET COMMENTARY: THE LONGER-TERM RHYTHM AND CONSEQUENCES OF GLOBALIZATION

September 7, 2022

Globalization as we know it seemed to have hit its peak around a decade ago. Global trade as a percentage

MARKET COMMENTARY: WHY (AND HOW) ARE GAS PRICES DOWN?

August 8, 2022

On June 14, the national average for regular unleaded gas was $5.016 per gallon. As of August 1, the average

MARKET COMMENTARY: MENTAL GYMNASTICS

July 18, 2022

The mind is a powerful thing. We have heard the saying, we know it to be true, and we can

MID-MONTH MARKET COMMENTARY: A THREE-DAY 10%+ DROP… A U.S. BEAR MARKET… WHERE ARE WE NOW?

June 17, 2022

A surprise European Central Bank interest rate hike followed by a “bad” print on a closely watched inflation gauge created

MARKET COMMENTARY: HOW LONG WILL WE FEEL COVID REVERBERATIONS?

June 6, 2022

Throw a pebble in a still lake and you create a ripple. As one moves further from the center, the

MARKET COMMENTARY: ‘40S OR ‘70S – WHAT’S THE BETTER COMPARISON?

May 6, 2022

It was late 1940, some of the darkest days of the war for Great Britain. The Luftwaffe was indiscriminately bombing

MARKET COMMENTARY: INFLATION, INVASION, INNOVATION!

April 16, 2022

In Smokey and the Bandit, Burt Reynolds wins a challenge by illegally taking alcohol over state lines in a big

MARKET COMMENTARY: FINANCIAL IMPLICATIONS OF THE RUSSIAN INVASION OF UKRAINE

March 4, 2022

First, our hearts go out to the 40 million plus citizens of Ukraine. It is impossible to imagine or feel

MARKET COMMENTARY: READJUSTING THE LENS IN LOOKING PAST CURRENT MARKET HEADWINDS

February 4, 2022

The market has become quite complicated lately, with several negative events coming to the forefront of investors’ focus, muddling the

MARKET COMMENTARY: WHERE ARE WE GOING? DISRUPTION, UPHEAVAL, INNOVATION!

January 14, 2022

A front-line chicken processing plant job is among the less desirable positions available. One must stand all day on an

MARKET COMMENTARY: SUPPLY CHAIN TRAFFIC SNARL EXPLAINED

December 3, 2021

The global supply chain has been built over the course of the last few decades to maximize profit through providing

MARKET COMMENTARY: MAKING SENSE OF CHINA: BUY OR SELL?

November 5, 2021

Alibaba (BABA), a Chinese company primarily focused on e-commerce, is frequently compared to Amazon (AMZN), an American company with a

ADVISOR COACHING CALL WITH MICHAEL SILVER

October 29, 2021

For this Advisor Coaching Call we will be discussing how to Segment Your Book to SCALE Your Business.

MARKET COMMENTARY: RECOGNIZING AND COMBATTING BIASES IN INVESTING

October 15, 2021

True story: A father and son are caught stealing a TV. There is no question they did it. The father

MARKET COMMENTARY: JOBS – ALL-TIME HIGH JOB OPENINGS VS ALL-TIME LOW JOB PARTICIPATION: WHAT GIVES?

September 3, 2021

Serfdom in Europe was destroyed by the Plague. It was destroyed because there were too few serfs to do the

MARKET COMMENTARY: WHAT DELTA MEANS FOR THE MARKET

August 6, 2021

New cases of Covid have unfortunately increased over the last few weeks as the Delta variant has become the dominant

MARKET COMMENTARY: HOW DO MARKETS REALLY WORK?

July 15, 2021

It’s always a bit scary when going onto one of those travel sites, like Expedia, with the goal of booking

PROSPECT OR DIE

July 8, 2021

“If you’re not prospecting, you’re dying.” While a bit bold, that one liner mentioned in a recent Fountainhead sponsored webinar

MARKET COMMENTARY: TIMING THE TOP

May 12, 2021

In one of our first Explorations we had shared the following chart which illustrates that, at least historically, the longer

MARKET COMMENTARY: DECLINING PRODUCTIVITY?

April 28, 2021

How exactly is productivity defined and why has it been so lackluster as of late?

MARKET COMMENTARY: EXUBERANCE? MANIA? OUR TAKES ON GAMESTOP, DOGECOIN & SPACS

February 1, 2021

The first thing one learns in Economics is the Supply & Demand curve. It is so simple yet so powerful

MARKET COMMENTARY: THE US TREASURY -FEDERAL RESERVE CONNECTION & ASSOCIATED IMPLICATIONS

January 1, 2021

Janet Yellen has made history. She is now the only person to serve as both the head of the Federal

MARKET COMMENTARY: Is Our Empire Crumbling?

December 15, 2020

Immediately following the end of World War II, the US dominated as no empire had in the history of empires.

MARKET COMMENTARY: SOCIAL CHANGES, LOW YIELDS &THE EFFECTS ON GROWTH STOCKS

November 1, 2020

Thank God for technology. My children can attend school, socialize with friends, and waste away their days watching an infinite

MARKET COMMENTARY: MONEY! WEALTH’S GREATEST CREATION

October 9, 2020

Money is a human convention. Populations need to be convinced one way or another that currency has value.

MARKET COMMENTARY: COVID TIMELINE AND IMPLICATIONS

October 1, 2020

The good news is that 2020 is almost over. The bad news is that calendars are a human convention and

MARKET COMMENTARY: IS THE US MONEY GOOD?

August 26, 2020

America shut down for business rather quickly once it was evident that COVID was on our shores.

MARKET COMMENTARY: TESLA –OPPORTUNITY OR BUBBLE?

August 1, 2020

Tesla is a hot name for good reason. They are changing the world and hopefully for the better. They are

MARKET COMMENTARY: MARKET RISK DUE ELECTIONS (DELAY/FRAUD ACCUSACTIONS) MATERIAL

July 1, 2020

Over the last 10 days of July, President Trump warned 6 times that the election would be inaccurate and fraudulent

MARKET COMMENTARY: ARE WE SWEDEN? CONTINUED COVID = ELECTION RISK

May 1, 2020

After a ho-hum start, 2020 is turning out to be a historical year. Possibly one talked about for a long

MARKET COMMENTARY: COVID-19 (CORONAVIRUS): CURRENT AND FUTURE IMPLICATIONS

April 1, 2020

COVID-19 (Coronavirus): Current and Future Implication

MARKET COMMENTARY: IS THE PUBLIC HEALTH AND ECONOMIC POLICY RESPONSE ADEQUATE?

April 1, 2020

Dring up Avenue of the Americas there is no traffic, almost no people beyond sporadic groups waiting on food lines

COVID-19 (CORONAVIRUS) UPDATE

February 25, 2020

On Monday, February 24, world markets took a large one day hit due to fears that COVID-19 would become a

MARKET COMMENTARY: COMPANY VALUATIONS IN CONTEXT TO COVID-19

February 1, 2020

Having issued a COVID-19 Update just last week and with everyone in the world laser-focused on the spread and immediate

MARKET COMMENTARY: LONGER TERM EFFECTS OF THE VIRUS AND HOW FAR WE HAVE COME

January 1, 2020

Will the Coronavirus have the ability to trigger a global economic slowdown resulting in a dip in financial markets?

Case Studies

UGLY DUCKLING OR SWAN?

April 8, 2021

Uncover opportunity via single client review and quickly apply to select Investment Models

Podcasts

INVESTMENT WARS: WILL THE CRYPTO ECOSYSTEM DISRUPT BOTH FIAT CURRENCY AND DIGITAL TECHNOLOGIES?

April 16, 2024

Debate: Will the Crypto Ecosystem Disrupt Both Fiat Currency and Digital Technologies? Featuring: David LaValle, Senior Managing Director and Global

INVESTMENT WARS: DO RECENT DISRUPTIONS IN THE REAL ESTATE SECTOR CREATE OPPORTUNITY IN 2024?

March 19, 2024

Debate: Do Recent Disruptions in the Real Estate Sector Create Opportunity in 2024? Featuring: Lauren Hochfelder, Co-Chief Executive Officer of

INVESTMENT WARS: WILL ROBOTS TAKE OVER THE WORLD?!

February 8, 2024

Debate: Will Robots Take over the World?! Featuring: Zeno Mercer, an expert on Robotics with VettaFi RoboGlobal Indexes. Zeno is

INVESTMENT WARS: HOW STRONG IS THE TREND TOWARDS RESHORING OF MANUFACTURING?

January 16, 2024

Debate: How Strong Is the Trend Towards Reshoring of Manufacturing? Featuring: Chris Semenuk, Investment Partner with Tema ETFs. Is the

INVESTMENT WARS: AN INSIDER VIEW OF DISRUPTION WITHIN THE AUTO INDUSTRY

December 20, 2023

Special Episode: An Insider View of Disruption within the Auto Industry Featuring: Dr. Philip Koehn, who has over two decades

INVESTMENT WARS: IS COMMERCIAL REAL ESTATE A RISK OR OPPORTUNITY?

December 6, 2023

Debate: Is Commercial Real Estate a Risk or Opportunity? Featuring: Burl East, Portfolio Manager and Chief Executive Officer of American

INVESTMENT WARS: WILL THE US HAVE A DEEP RECESSION?

November 8, 2023

Debate: "Will the US Have a Deep Recession?" Featuring: Victoria Vogel, CFA, Senior Vice President and Product Specialist for Fixed

INVESTMENT WARS: WILL THE US HAVE A SHALLOW RECESSION?

October 18, 2023

Debate: "Will the US Have a Shallow Recession?" Featuring: Jack Janasiewicz, CFA, Portfolio Manager and Lead Portfolio Strategist for Natixis

INVESTMENT WARS: CHINA IN TRANSITION – WILL THE CHINESE CONSUMER AND CAPITAL SPEND DRIVEN INNOVATION PROPEL CHINA FORWARD?

September 26, 2023

Debate: "China in Transition: Will the Chinese Consumer and Capital Spend Driven Innovation Propel China Forward?" Featuring: Malcolm Dorson, Head

INVESTMENT WARS: CHINA, INNOVATION AND YIELD CURVE TEASER

September 13, 2023

After a breather taken during August we are excited about the upcoming podcasts we plan to publish discussing how the

INVESTMENT WARS: HOW DO HIGHER RATES AFFECT THE ECONOMY AND MARKET?

August 9, 2023

Debate: "How Do Higher Rates Affect the Economy and Market?" Featuring: Bob Grunewald, CEO & Founder of Flat Rock Global,

INVESTMENT WARS: THE RESILIENCE OF THE 60/40 PORTFOLIO

July 19, 2023

Debate: "The Resilience of the 60/40 Portfolio" Featuring Chris Tidmore, Senior Manager for the Vanguard Investment Advisory Research Center. The

INVESTMENT WARS: WILL WE HAVE A HARD LANDING?

June 21, 2023

Debate: “Will We Have a Hard Landing?” Featuring Matthew Miskin, Co-Chief Investment Strategist at John Hancock Investment Management. We have

INVESTMENT WARS: US DEBT LEVELS ARE TOO HIGH

June 7, 2023

Debate: “US Debt Levels are Too High” Featuring Matt Orton, Head of Advisory Solutions and Market Strategy at Raymond James

INVESTMENT WARS: FUTURE OF JOBS

May 17, 2023

Debate: “Wage Inflation Will Increase for the Foreseeable Future Due to a Tight Supply of Workers” Featuring Jeremie Capron, Director

INVESTMENT WARS: DEMOGRAPHICS – AGING OF US / DEVELOPED MARKETS WILL CAUSE DEFLATION

April 24, 2023

Debate: “Aging of the US Population Will Cause Deflation” Featuring Brian LoDestro, Senior Portfolio Strategist at PGIM Fixed Income, and

INVESTMENT WARS: DEBATE ON INFLATION

March 30, 2023

Introducing...Investment Wars! Our inaugural episode features Meera Pandit, Executive Director, Global Market Strategist at J.P. Morgan Asset Management & Lara

HOW DO COGNITIVE BIASES LEAD TO INVESTMENT MISTAKES?

October 22, 2021

Featuring Dr. Brooke Struck, Research Director at The Decision Lab.

ADVISOR COACHING CALL WITH MICHAEL SILVER

September 21, 2021

For this first installment of our monthly coaching call with Michael Silver, we will be discussing Value Proposition & your

MARKETING IDEAS FOR FINANCIAL ADVISORS

June 29, 2021

Where to next? The road to recovery has begun...how are you rethinking your marketing and investment strategy? For many Advisors, marketing activities

DECLINING PRODUCTIVITY?

April 26, 2021

Featuring Dr. Jessica Hirsh Weiss, Co-founder & Director, Grand Central Psychology