HOW PARTNERING WITH AN OCIO ALLOWS ADVISORS TO BETTER SERVE TODAY’S HIGH NET WORTH INVESTORS

The concept of using an Outsourced Chief Investment Officer (OCIO) to manage fiduciary risk while providing more specialized investment resources began in the corporate world, where pension fund managers turned to external managers for their marketplace knowledge and expertise. The idea quickly gained traction in the endowment and foundation communities, where boards and committees recognized the advantages of a co-fiduciary who was specialized in the task of investment management, while also better equipped to handle risk management. Over the past decade, this trend has continued and broadened.

Today’s high net worth investors are demanding the same level of service and responsiveness from their advisors. As a result, those independent advisors seeking maximum flexibility and customization for their clients have turned to the expertise of an Outsourced Chief Investment Officer.

This comprehensive solution is well suited for advisors seeking access to consultative advice, niche investment and risk management. While there is a cost associated with hiring this level of investment expertise and oversight, the value of personalized communications, aligned investment advice and responsiveness to market changes are a few of the common reasons why financial advisors choose to outsource to an Outsourced Chief Investment Officer.

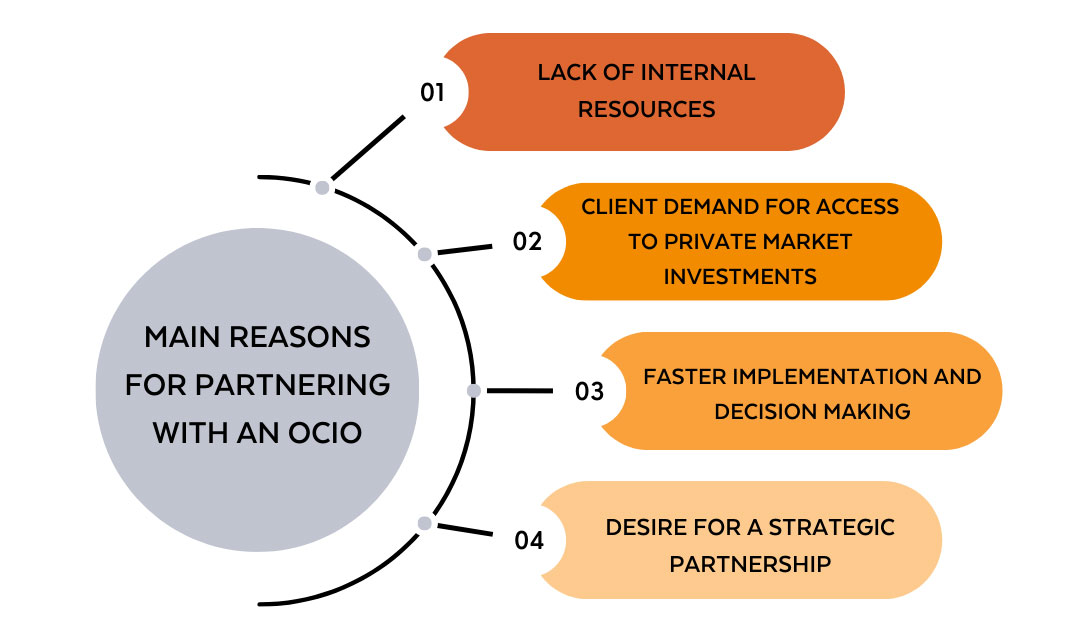

REASONS TO PARTNER WITH AN OUTSOURCED CHIEF INVESTMENT OFFICER

Growing complexities of investment options, muted return expectations and increased volatility are a few of the headwinds facing financial advisors and their clients. Having a fully staffed internal solution is not only expensive, but it also brings with it a host of personnel and human resource responsibilities. An Outsourced Chief Investment Officer approach allows a financial advisor to access market intelligence alongside a structured investment process that is able to make nimble investment decisions in an ever-changing financial landscape.

The wave of recognition around private market investments as a source for additional risk diversification and investment return creates complexities for the typical independent advisor. These alternative investments traditionally come with a wide range of challenges, such as proper due diligence and transparency, ongoing monitoring and administrative challenges due to capacity constraints. An Outsourced Chief Investment Officer is best positioned to provide this support to financial advisors and their clients, given their deep resources and experience managing less liquid investment options.

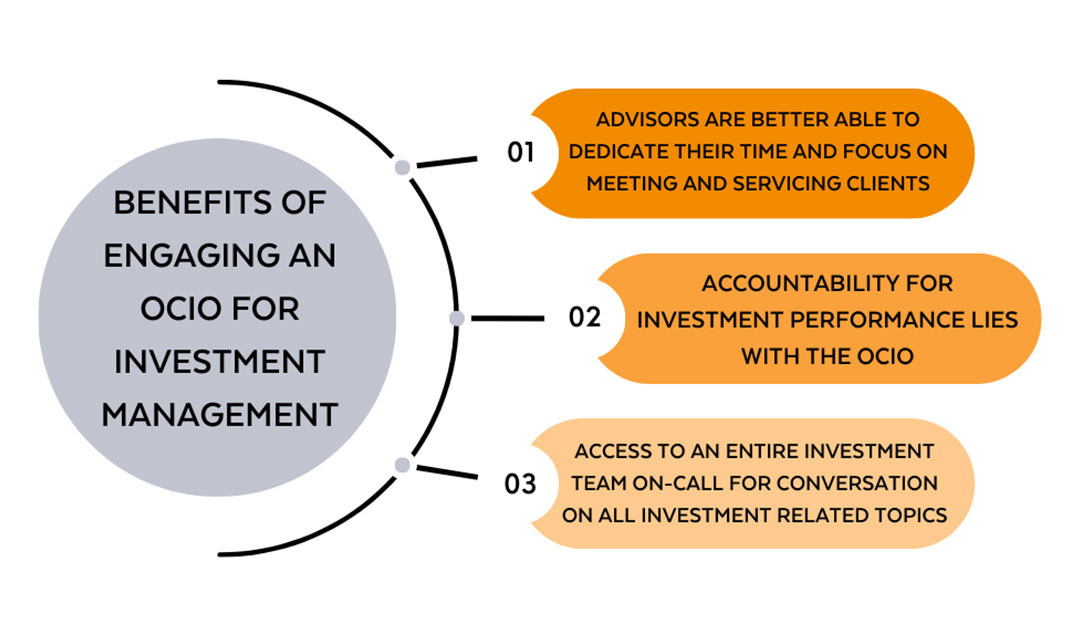

KEY BENEFITS OF PARTNERING WITH AN OUTSOURCED CHIEF INVESTMENT OFFICER

In a world where technological solutions are constantly evolving, the personalized services an Outsourced Chief Investment Officer provides to advisors allow them to differentiate themselves from other financial service providers while also providing potential cost savings. There are a host of services advisors provide for high net worth investors that cannot be automated, namely planning and investment conversations, investment research and ongoing investment servicing and monitoring. With staffing accounting for roughly 15% of the typical advisory firm’s revenue, an Outsourced Chief Investment Officer partner can help advisors leverage their time by gaining additional staff expertise in the areas of planning and investments. The Outsourced Chief Investment Officer is more than just an investment solution—they are a dynamic resource for all investment-related questions and conversations an advisor and their clients may have.

To learn more about the power of partnering with Fountainhead Asset Management, visit our website at fountainheadam.com. Enhance Your Story With Us.

IMPORTANT DISCLOSURE: The information contained in this report is informational and intended solely to provide educational content that we find relevant and interesting to clients of Fountainhead. All shared thought represents our opinions and is based on sources we believe to be reliable at the time of publication. While we continue to make these reports available, we do not update past reports in light of subsequent events. Nothing in this letter should be construed as investment advice; we provide advice on an individualized basis only after understanding your own circumstances and needs.