AS THE RIA MODEL CONTINUES TO GROW, HOW DO ADVISORS DETERMINE WHEN TO BECOME INDEPENDENT?

Over 90% of advisors who made the transition to Independent RIA say they are happy they did so, and if given the opportunity, they would do it again [1]. If that wasn’t enough of an endorsement, their most common regret? Not doing it sooner!

So why do advisors stay so long in a sub-optimal environment, and what is it that finally prompts them to become an independent financial advisor? While every advisor has their own reasons, there are reoccurring themes and pressures that ultimately lead to action or inaction.

PUSHES AND PULLS

As Newton’s first law states: “An object at rest remains at rest unless acted on by a net force.” The same can be said of financial advisors and the business model that they operate in. The status quo often leaves people content and unresolved to take action… unless acted upon by a net force.

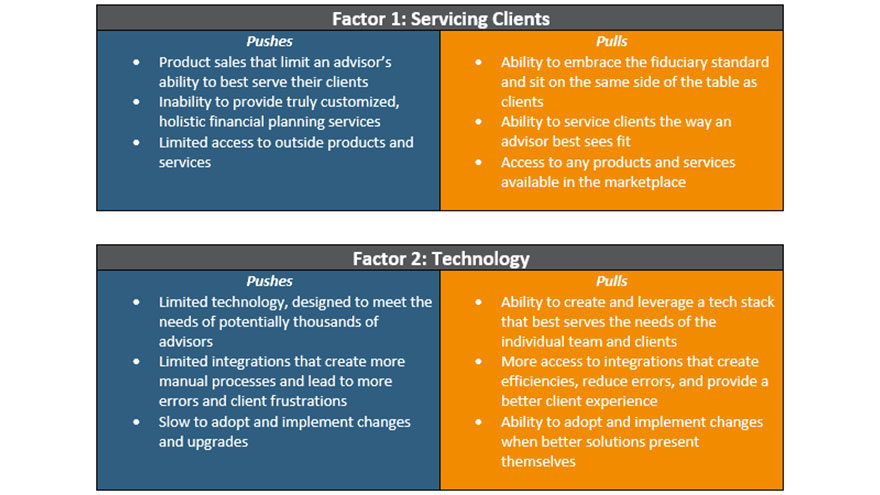

The forces acting upon financial advisors at a broker-dealer or wirehouse can be broken into two categories: pushes and pulls. Pushes are made by external forces—typically a broker-dealer, OSJ, or upper management—that make operating more difficult or more costly. The pulls are the allure of something better—a better way to serve clients, build and grow enterprise value, or gain control over the business that they’ve created.

Rarely does a singular push or pull drive action. More often, it is a combination of multiple forces creating a simultaneous push and pull strong enough to set an advisor into motion. For advisors operating out of broker-dealer or wirehouse model, there are four forces that routinely push or pull them into the RIA Model.

| Factor 1: Servicing Clients | |

|---|---|

|

Pushes

|

Pulls

|

| Factor 2: Technology | |

|---|---|

|

Pushes

|

Pulls

|

| Factor 3: Compliance | |

|---|---|

|

Pushes

|

Pulls

|

| Factor 4: Economics | |

|---|---|

|

Pushes

|

Pulls

|

BOTTOM LINE

Independent financial advisors are driven to breakaway by the culmination of net forces. When these forces reach a tipping point, advisors find themselves in a situation where it is more costly to stay put than to move. The costs are twofold. There is the cost of attrition brought on by restrictions, fees, and inefficiencies, and there is the is the cost of opportunities missed by not acting sooner.

While most advisors are keenly aware of the pushes and frustrations that they feel from time to time, they are often unaware of the pulls that would ultimately tip the scales. Only by taking the time to vet and understand their options can they get a true sense of when the time is right for them to become independent financial advisors.

Sources:

To learn more about the power of partnering with Fountainhead Asset Management, visit our website at fountainheadam.com. Enhance Your Story With Us.

IMPORTANT DISCLOSURE: The information contained in this report is informational and intended solely to provide educational content that we find relevant and interesting to clients of Fountainhead. All shared thought represents our opinions and is based on sources we believe to be reliable at the time of publication. While we continue to make these reports available, we do not update past reports in light of subsequent events. Nothing in this letter should be construed as investment advice; we provide advice on an individualized basis only after understanding your own circumstances and needs.