FOR ADVISORS WHO HAVE CHOSEN TO MOVE TOWARDS INDEPENDENCE, NOW WHAT?

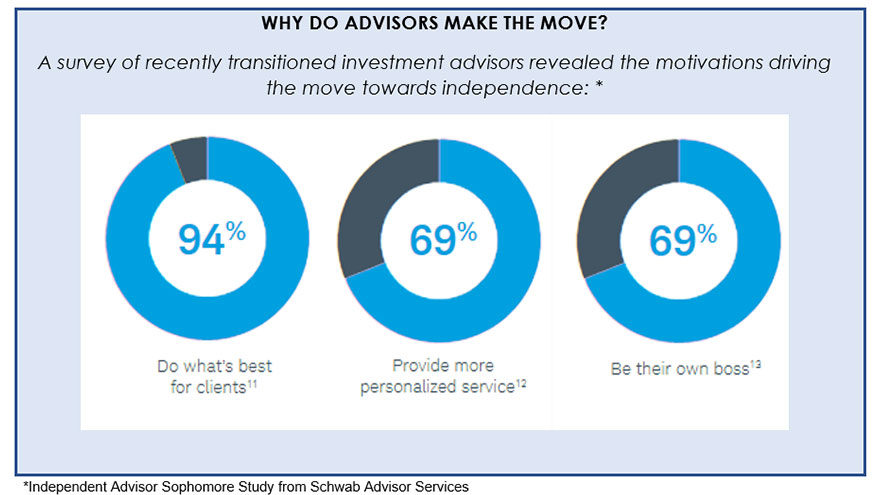

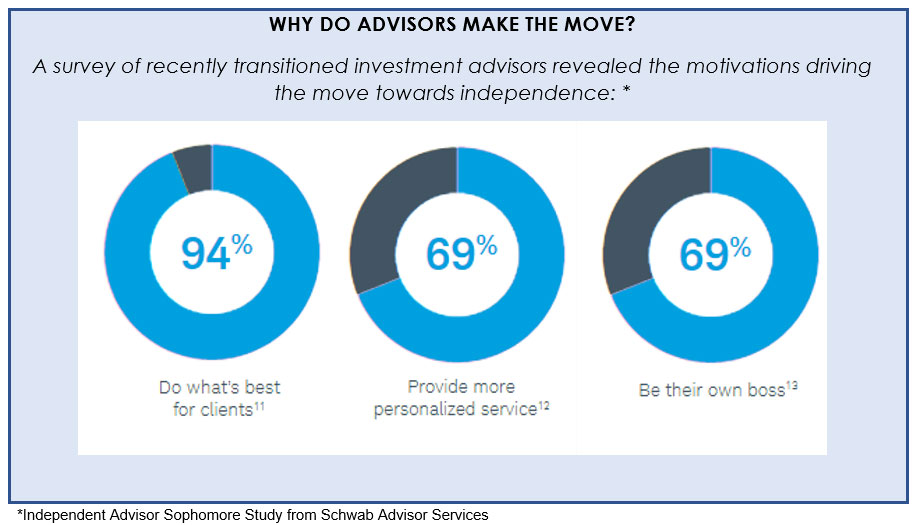

RIA firms represent the fastest growing category in the U.S. wealth management market since 2016 [1]. The trend to independence shows no sign of slowing down, as entrepreneurial-minded and client-focused advisors continue to exit large brokerage and wirehouse firms in search of more freedom, flexibility, and control. While there are several factors influencing this migration, the driving force continues to be advisors seeking a better sense of fulfillment in how they work with their clients while maximizing the value and equity in their own business.

After deciding on the direction of independence, most advisors are still unprepared to navigate the various options available in the space, making it difficult to conceptualize a clear path to a transition. The basic road to independence can be broken down into two main pathways: start your own RIA or join an existing one. Within each choice there are a multitude of available options, with some subtle and not so subtle differences.

OPTION 1: START YOUR OWN RIA

For many disenchanted advisors breaking out of the “big brother” atmosphere of a large wirehouse or insurance broker-dealer, the opportunity to “hang their own shingle” can be alluring. This option, attractive to the most entrepreneurial-minded, offers the ability for advisors to establish a firm that represents the values, philosophy, and culture that they want. Additionally, it affords maximum autonomy and flexibility. Advisors are free to work with who they want and how they want. This includes not only who and how they work with clients, but also what technology they adopt, how they market themselves, and what services they choose to offer and how they price them.

The flipside is that choosing all of your service providers and platforms can be a daunting task, and one that takes an advisor away from their core strength of meeting with and servicing clients. There are countless choices that must be made in order to build your own firm, including:

- Legal Structure of the Firm

- Custodian

- Investment Management

- Client Deliverables

- Billing

- CRM

- Regulatory Registration

- Performance Reporting

- Financial Planning

- Marketing

- Compliance

- Books and Records

Within each of these decisions, there are again hundreds of options of providers. There is also the obstacle of finding vendors who integrate, and then staying atop of the latest innovations in the FinTech space and monitoring your vendor relationships going forward.

When determining if starting your own firm is right for you, there are several other factors to consider, including:

ENTREPRENEURIAL MINDSET

Do you have the business acumen and determination required to manage and run your own advisory business?

COSTS

While there are no minimum assets under management to start your own RIA, you need to be equipped to incur the various startup costs and capital requirements.

DIFFERENTIATION STRATEGY

Are you prepared to build a differentiated brand? What makes your business different from your competition?

Establishing your own RIA requires countless hours of time and energy, not to mention cost, in order to properly navigate all of these crucial decisions. While there is an entire ecosystem of professionals focused on helping advisors navigate and start their own firm, due to the cost and complexity, many advisors choose to join an already established RIA rather than build their own.

OPTION 2: JOIN OR “TUCK IN” WITH AN EXISTING RIA

Joining, or what’s commonly referred to as “tucking in”, with an existing RIA is an option for advisors looking for independence and the advantages of moving to an RIA without the challenge and burden of building it all themselves. The advisor affiliation route has grown in popularity, and with nearly 50% of RIA firms over $250M in AUM actively seeking to add established advisors [2], there is no shortage of potential partner firms to choose from.

Within this path there is a wide variety of options for one to weigh. There are large aggregator RIAs, who specialize in providing breakaways with a plug and play platform, and there are more boutique options for advisors looking for more personalized solutions. Regardless of the direction, it is important that advisors identify a firm that aligns with their values while allowing them the flexibility to do what’s best for their clients, run their business the way they see fit, and build enterprise value in their practice.

The advantages to joining an RIA include a savings of both cost and time. There is less upfront cost to join what someone else has already built, while also leveraging the platforms, processes, and systems that have been vetted. There are also economies of scale to be gained when aligning your interests with a larger organization. Once the decision has been made to join a firm, the next challenge is to find the optimal firm to partner with. No two advisors are alike, and the best fit for one advisor may not be the best fit for the next. The key to making an informed decision is to understand what support you need, in what areas you want to maintain more autonomy, and how much you are willing to pay for these services. The different players in this space, and there are thousands of them, will vary in their relationship with you, the advisor. When evaluating potential partners some important things to consider are:

BRANDING

Is it important for you to leverage an established brand, or would you prefer the flexibility to operate as your own DBA?

COMPENSATION VS. SUPPORT

Is the platform charge reflective of the value you will receive from the support and services the partner firm provides?

CULTURAL FIT

Are you in alignment with the firm’s goals and values?

OWNERSHIP

Does the firm require a stake in your business? Are you comfortable with the terms of their ownership?

THE BOTTOM LINE

There is no one right path to independence. It is up to the individual to evaluate what option will allow them to best serve their clients, while also allowing them the opportunity to maximize the potential enterprise value of their business.

In addition to the freedom and flexibility that come with running your own firm, the biggest draw for many is the ability to build enterprise value in their business. 2021 saw RIA valuations hit an all-time high and they are projected to accelerate further in 2022 [3]. For entrepreneurial advisors with a long-term vision, the fully independent RIA model provides an opportunity to establish, build, and grow an enterprise and a legacy without impediments and conflicting interests of large institutions.

Sources:

- McKinsey & Company: Registered investment advisors: How US banks can weigh the M&A potential

- Charles Schwab: 2022 RIA Benchmarking Study

- DeVoe & Company: DeVoe Annual RIA M&A Outlook Report

To learn more about the power of partnering with Fountainhead Asset Management, visit our website at fountainheadam.com. Enhance Your Story With Us.

IMPORTANT DISCLOSURE: The information contained in this report is informational and intended solely to provide educational content that we find relevant and interesting to clients of Fountainhead. All shared thought represents our opinions and is based on sources we believe to be reliable at the time of publication. While we continue to make these reports available, we do not update past reports in light of subsequent events. Nothing in this letter should be construed as investment advice; we provide advice on an individualized basis only after understanding your own circumstances and needs.