Learning from Modern Advisory Practices of Dreams

“If you build it, he will come.” The famous quote from the 1989 movie, Field of Dreams, is the counterpoint to Kevin Costner’s character Ray’s fear that the resources and energy he is pouring into building a baseball diamond in his cornfield is a futile effort. Terence Mann, played by James Earl Jones, stands beside Ray and gives him the confidence to pursue his vision, telling him, “People will come, Ray.”

Today, many financial advisors, including independent advisors, find themselves in a similar position to Ray. They are staring at the cornfield, envisioning their Practice of Dreams. Those in the scaling phase of their practice may find themselves questioning whether the platform they began on many years ago still serves their business model and their clients’ needs. Like any relationship, it is commonplace to wonder whether you have grown together or apart after many years. Advisors whose practice is in the emerging phase may wonder if the platform they are on today will take them to the next level in the industry. What will the next 20 years look like as the industry evolves and advances? And if you are contemplating a move, what will that look like? Most importantly, if you choose to build it, will your clients come?

Finding the Best Roadmap for Your Business

It is impossible to understand where your practice sits on the continuum of the modern advisor without performing thorough due diligence on your current business structure. In fact, it is critical to get a realistic picture of not only what your future ideal practice looks like but also what it looks like today. In other words, you cannot just focus on where you want to go. It would help if you were critically clear on where you are starting from. Think of this as the GPS of your business. You need a destination; however, you also need a starting point to identify the best roadmap.

A practice assessment is an ideal starting point and allows you to uncover critical components of a successful practice—and where the true growth drivers lie. There are many tools and professionals available who can assist you through the process, or you can perform your own basic assessment to get started. To understand your practice as a business, focus your review on these four key pillars to perfect your modern advisory practices:

Business Strategy and Planning:

- What percentage of your time is spent working “on” your business (not just “in” it)?

- What Operating System are you using, and is it reflective of your practice’s culture and value proposition? Does your current platform support your methodology?

Client Experience and Operations:

- Is your client experience consistent across the entire process, from the first touchpoint through onboarding? Is the process streamlined and automated where possible?

- What key areas have you chosen to outsource to scale your time and focus on your unique abilities?

Marketing and Business Development:

- Are your branding, messaging, and marketing defined and aligned?

- What are the drivers of your organic and inorganic growth?

Human Capital and Structure:

- When and how do you hire staff?

- What are the next best investments you should be making in your practice?

Should You Build it, Lease it, or Partner?

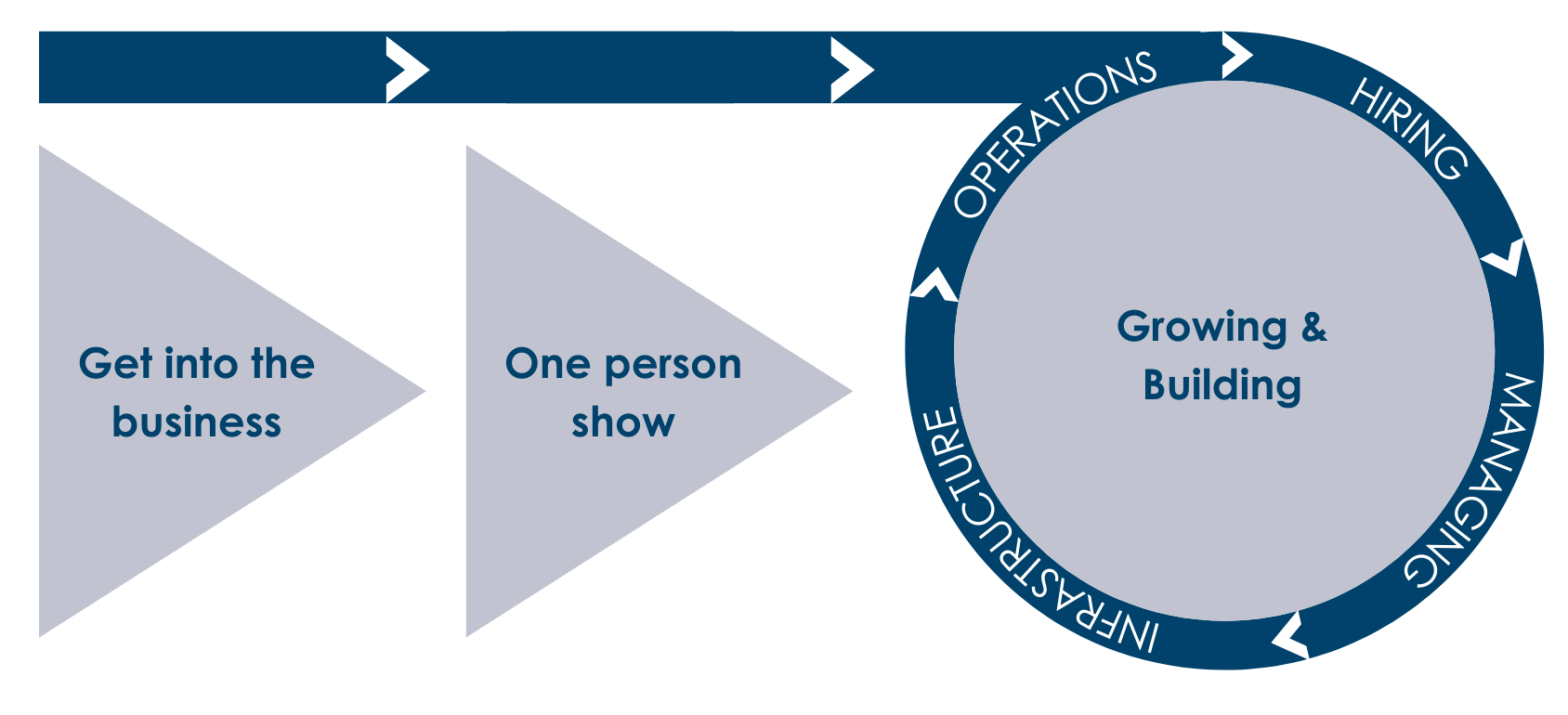

The rut many financial advisors fall into is they have been in the industry for many years and the growth of their practice has gone something like this…

Getting Into the Business

Talk to anyone who will talk to you to try and grow the business. Struggle and focus on closing clients, not planning for clients. This typically results in talking to clients from a commission standpoint.

Evaluating the One Person Show

You start to build momentum, now clients are coming in, and perhaps you are even starting to generate referrals (although you aren’t exactly sure how). You are a one person show, do-er of everything, master of nothing. You recognize a need for help. You question whether it is worth it to lay out capital, to invest in yourself, or to change the business model. Will it pay off? How will you manage someone? You got into this business to help people manage their finances, not to run human resources.

Growing & Building Your Business

Eventually, you make the hire, allowing you to continue growing and building. As you continue to grow, you become saddled with the same issues again. Hiring, managing, infrastructure, operations. It is circular, a cycle. It all goes along with being a financial advisor and yet none of it is fulfilling when what you enjoy, and what you are good at, is working with clients.

Logical Next Steps for Financial Advisors

To break this cycle, advisors today are looking for options. Yet, moving firms is a time-consuming and complex process. A common mistake is that advisors tend to focus on the practice they have instead of the practice they want. This leads them to make the “next logical move”, for example, from a broker/dealer to an independent broker/dealer, when they really want to hang their own shingle and be a true business owner.

Today’s financial advisory industry is fragmented, with many choices of platforms and structures. According to the recent 2021 Advisor Movement Study by BridgeMark Strategies, their internal data suggests that “82% of advisors choose to affiliate with smaller firms or smaller groups within larger firms. Advisors cite support and culture in firms and groups with fewer than 750 professionals as a primary reason for affiliation.” So, the proper question for advisors today is not “If you build it will they come?” but rather, “What Practice of Your Dreams do you want to build?”

Fountainhead Asset Management: It Starts with Your Story

Fountainhead Asset Management (FAM) is a growing platform for financial advisors interested in scaling and expanding their modern advisory practice. FAM’s platform provides advisors a partnership solution they can leverage for technology, institutional level investment management, practice development, marketing, compliance, and operations. Our Insights publication is designed to keep you well-informed of current events and their effects. Furthermore, we stand readily available to help you effectively communicate with your clients regarding such topics. Reach out to Fountainhead for further insights and tools on advisor best practices.

IMPORTANT DISCLOSURE: The information contained in this report is informational and intended solely to provide educational content that we find relevant and interesting to clients of Fountainhead. All shared thought represents our opinions and is based on sources we believe to be reliable. Therefore, nothing in this letter should be construed as investment advice; we provide advice on an individualized basis only after understanding your own circumstances and needs.